Our team comprises leading practitioners with a breadth and depth of experience in financial services investigations and enforcement

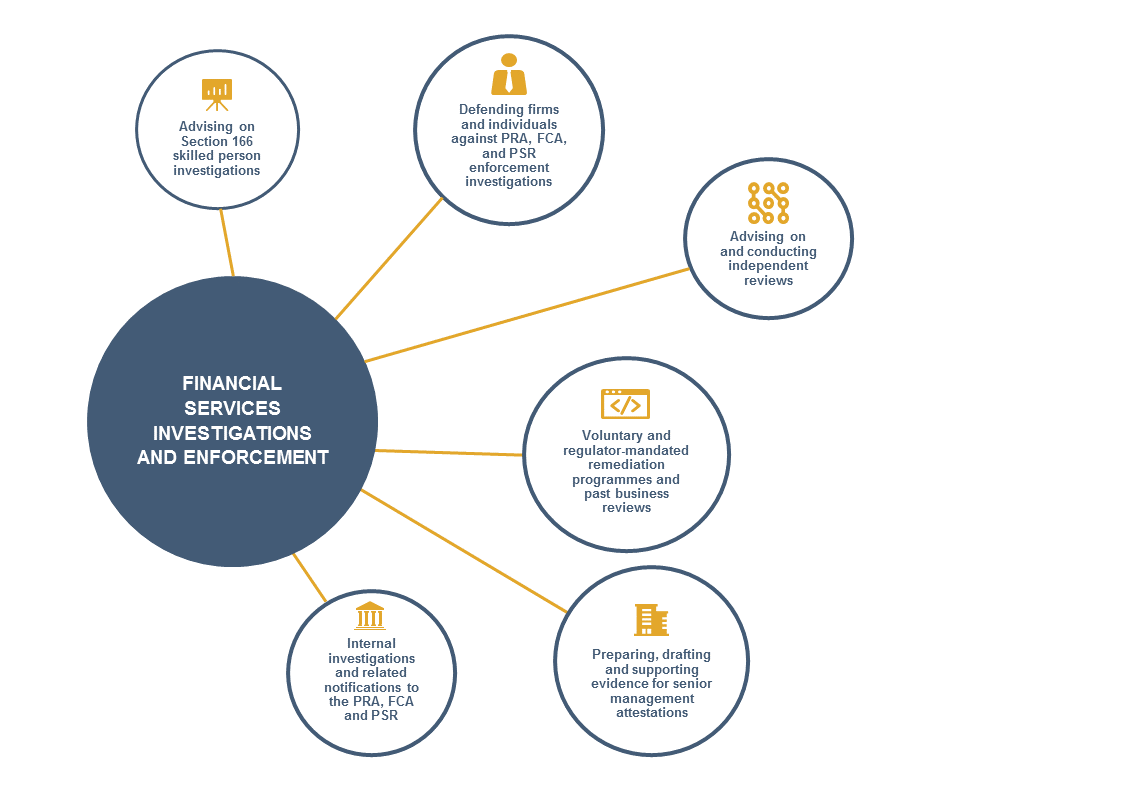

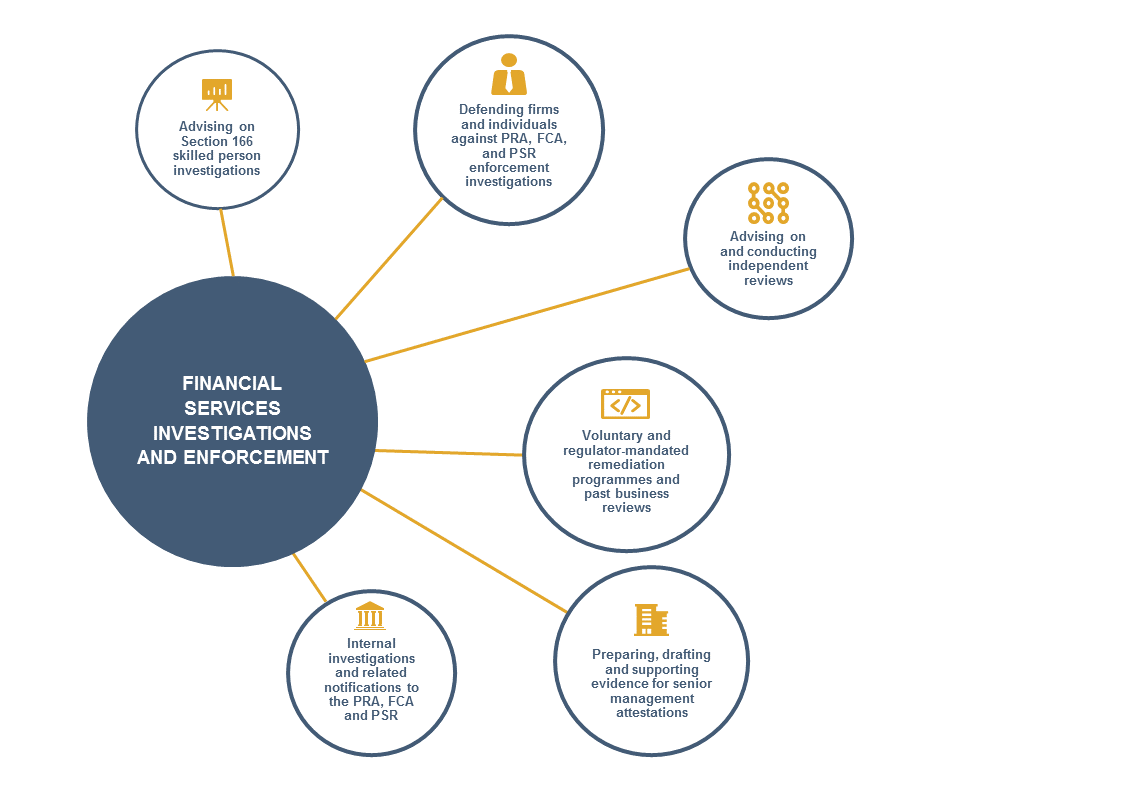

We have advised firms and individuals in many of the most high profile investigations by the Prudential Regulation Authority (PRA), Financial Conduct Authority (FCA) and Payment Services Regulator (PSR) leading up to and since the financial crisis of 2008. Our team also has deep experience of managing s.166 Skilled Persons investigations, conducting internal investigations, remediation and past business reviews, and advising on independent public reviews.

Our lawyers have extensive experience and understanding of the regulators' approaches, expectations, strategic objectives and wider market activity.

We are able to provide cost effective resource drawing on our large team in London and other offices, as well as our specialist e-data review team, TST.

We work closely with our specialist teams in corporate crime, financial regulation, compliance consulting, employment, finance litigation, competition and data privacy to deliver a seamless service drawing on the particular expertise that you need to address and resolve an issue in full and from all perspectives.

Our subject matter expertise includes advising on:

- market abuse investigations and risks, including under the European Market Abuse Regulation; AML systems and controls; LIBOR and foreign exchange benchmark manipulation; remuneration adjustment under the Remuneration Codes; culture and governance; client money and assets (CASS); complaints handling and Financial Ombudsman Service complaints under DISP; suitability of investment advice and disclosure of information under COBS; conflicts of interest; regulated mortgage lending under MCOB; and PRA and FCA notification rules including SUP 15.

We have advised clients across the financial services industry including:

- wholesale banking, wholesale trading, private wealth management, custody services, retail banking, insurers and insurance mediators, pension providers, retail and SME lenders, institutional asset managers, investment platforms, payment services and e-money firms, fintech firms, challenger banks and listed corporates.