(4 min read)

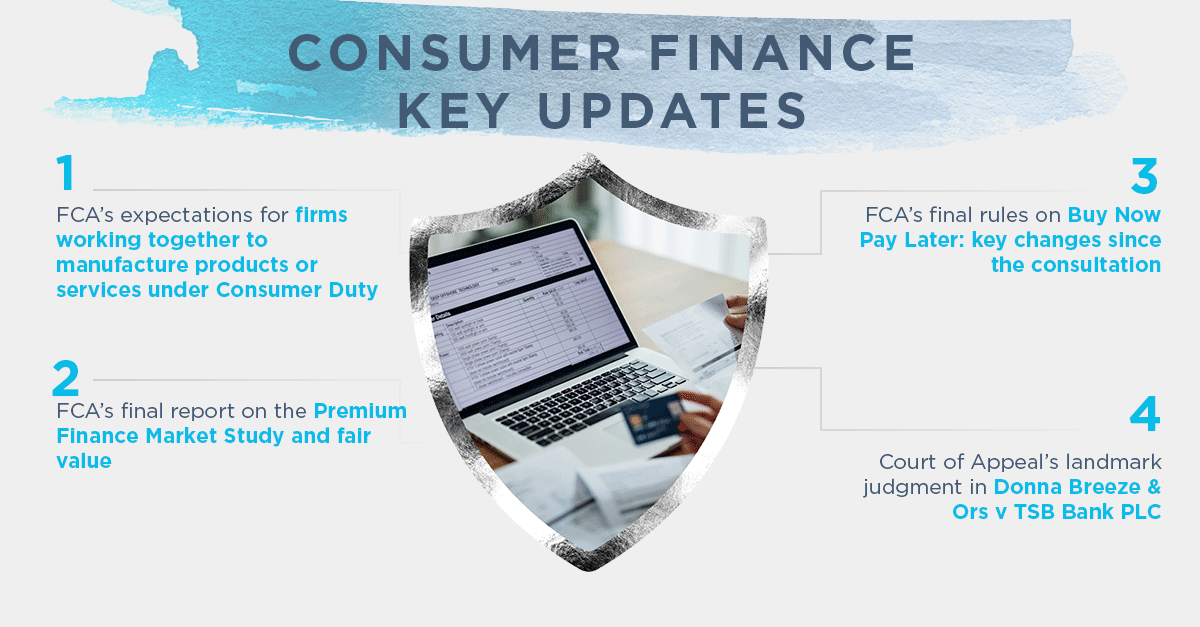

Consumer Duty marks a major shift in FCA regulatory expectations, with a current strong focus on delivering ‘fair value’ to customers. Recent FCA publications, including the final Premium Finance Market Study report, highlight ongoing concerns about fair value and urge firms to review their premium finance products for compliance. The Duty is now central to the FCA’s approach to Buy Now Pay Later, with final rules published and particular emphasis on consumer understanding and support. This issue examines these regulatory developments and their practical impact on firms, as well as analysing a key Court of Appeal decision from group litigation by former Northern Rock mortgage customers, which considers contractual interpretation and statutory unfairness under the Consumer Credit Act for regulated mortgage contracts.

FCA clarifies expectations for co-manufacturers under consumer duty

Consumer Duty continues to represent a significant shift in regulatory expectations and remains a key focus for the Financial Conduct Authority (FCA). Recent FCA publications have provided further clarity on the expectations for firms involved in the design and distribution of products and services, with a particular emphasis on the requirement to deliver ‘fair value’ to customers. In the article below we break down the FCA’s key expectations for firms and what this means in practice.

Read more here on the roles of co-manufacturers under Consumer Duty

Premium finance: Are your customers getting fair value?

The FCA has published its final report on the Premium Finance Market Study (MS24/2). The Market Study was launched over concerns by the FCA that some customers were not getting fair value and that competition was not functioning effectively. While the report acknowledges that the market is serving many customers well, it also highlights the ongoing issue of high prices. The FCA is now calling on all firms to take a hard look at their premium finance offerings and consider what further steps are needed to ensure they deliver fair value in line with regulatory expectations.

Read here on the FCA’s final findings and what they mean for premium finance firms

New Buy Now Pay Later regulations finalised: key changes since the consultation

The FCA has unveiled its much-anticipated final rules for Buy Now Pay Later (BNPL), also known as Deferred Payment Credit (DPC). The FCA’s policy statement, released on 11 February 2026, reveals that while most of the draft rules remain intact, a handful of important tweaks have been made following industry consultation. In this article, we unpack the key changes and explore what DPC lenders need to do now to ensure their systems and controls are ready for the new regime.

Click here to read on the FCA’s final rules and the impact for DPC lenders

Court of Appeal’s 2026 ruling reshapes the landscape for Northern Rock mortgage claims and transferred loan portfolios

On 30 January 2026, the Court of Appeal delivered a landmark judgment in high-profile group litigation Donna Breeze & Ors v TSB Bank PLC [2026] EWCA Civ 32 brought by former Northern Rock mortgage customers against TSB. This decision marks a pivotal moment, with far-reaching implications not only for the ongoing litigation but also for a wide range of cases involving former Northern Rock mortgages, other transferred mortgage portfolios, and connected credit agreements.

Read more on the Court of Appeal’s judgment here

Upcoming events

For information on our upcoming training events including our Regulatory Essentials programme, please visit our Financial Regulation page.