(3 min read)

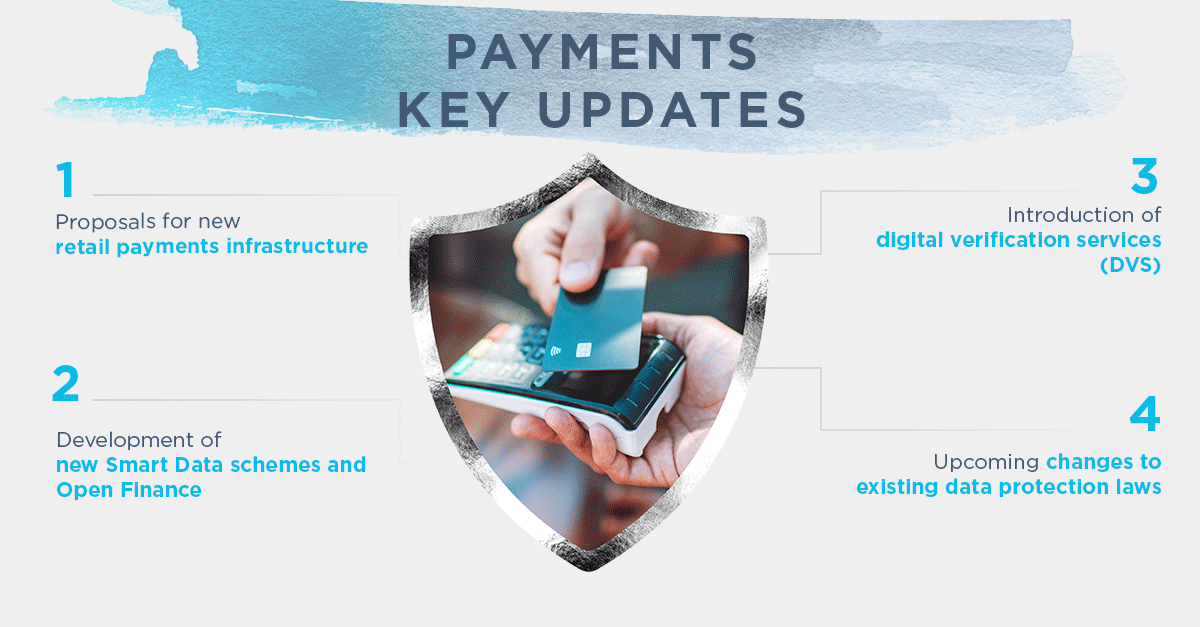

The UK is currently reshaping elements of the retail payments and data landscape. HM Treasury and the Bank of England are leading a new National Payments Vision, introducing governance reforms to boost innovation, competition, and security. Alongside this, the Data (Use and Access) Act 2025 sets out frameworks for Smart Data schemes, Open Finance, and Digital Verification Services, enabling secure data sharing and faster identity verification. Firms should prepare for regulatory changes, including updates to data protection laws and track key consultations due in late 2025. Ongoing stakeholder engagement will be vital in keeping abreast of these reforms.

Next generation payments

With the publication of the National Payments Vision (NPV), the UK Government has made it clear that supporting the UK's payments industry to flourish is a key component to their economic growth agenda. With this in mind, we are now starting to see some of what that means beginning to be fleshed out. In the last few weeks we have seen the following developments:

1. HM Treasury published an update outlining a new collaborative model to design and deliver next-generation retail payments infrastructure in the UK, aligning with the NPV.

2. The enactment of the Data (Use and Access) Act 2025. This legislation paves the way for new secondary legislation that will be pivotal in establishing a new regulatory framework for the oversight and future development of Open Banking and facilitate the growth of smart data schemes such as Open Finance. It also sets out the foundational requirements for the development of digital verification services which have the potential to transform how we interact with financial service and even online service more generally.

In this article we provide an overview of these developments and what they could mean for financial services firms.

Click here to see the detailed provisions of the Act impacting financial services firms and the upcoming changes in Open Banking

Upcoming events

For information on our upcoming training events including our Regulatory Essentials programme, please visit our Financial Regulation page on our website.

Next steps

If you want to find out what these updates mean for your business, or discuss training opportunities or systems and controls changes, please feel free to get in touch with our Payments and Data Protection teams who would be delighted to speak to you.