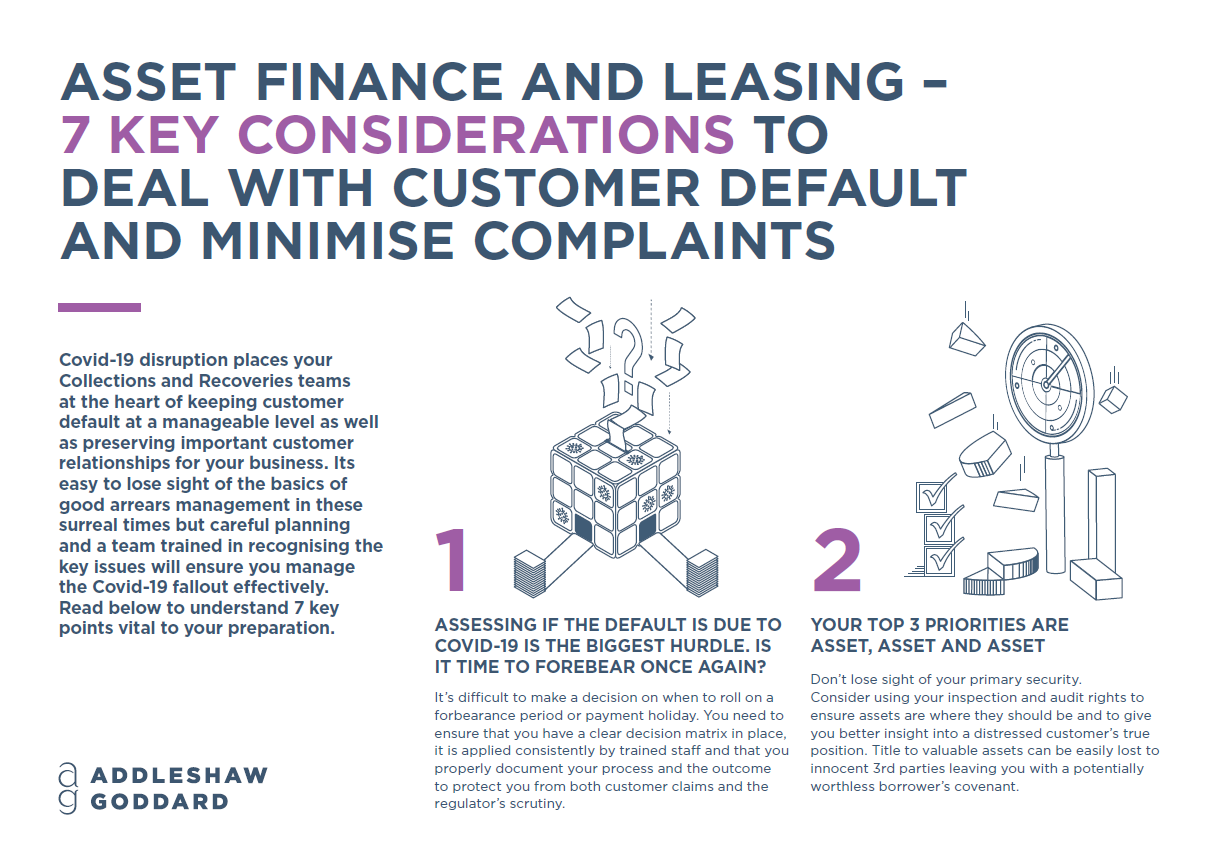

7 key considerations to deal with customer default and minimise complaints

Covid-19 disruption places your Collections and Recoveries teams at the heart of keeping customer default at a manageable level as well as preserving important customer relationships for your business. It's easy to lose sight of the basics of good arrears management in these surreal times but careful planning and a team trained in recognising the key issues will ensure you manage the Covid-19 fallout effectively. Just click on any of the expandable sections for a short summary, or click here to view the 2 page, print friendly version >

- 1. Assessing if the default is due to Covid-19 is the biggest hurdle. Is it time to forebear once again?

It’s difficult to make a decision on when to roll on a forbearance period or payment holiday. You need to ensure that you have a clear decision matrix in place, it is applied consistently by trained staff and that you properly document your process and the outcome to protect you from both customer claims and the regulator’s scrutiny.

- 2. Your top 3 priorities are asset, asset and asset

Don’t lose sight of your primary security. Consider using your inspection and audit rights to ensure assets are where they should be and to give you better insight into a distressed customer’s true position. Title to valuable assets can be easily lost to innocent 3rd parties leaving you with a potentially worthless borrower’s covenant.

- 3. What does it mean for you and your rights if your customer is insolvent?

Act quickly to assess the reason for insolvency. Can you rely on an automatic termination of your agreement to recover your asset? Contact an Administrator quickly to ascertain the importance of your asset to the business and to seek payment of rentals in the event of a moratorium. Is now the time to make demand under personal guarantees?

- 4. No smoke without a fire - you suspect fraud...

Fund raising frauds often come to light in times of distress. Identify and separate such cases as early as possible to ensure focussed recovery action. Consider urgent court action to recover assets at risk to reduce your exposure as well as personal claims against those in control of corporate customers. Those who act quickest often recover the most.

- 5. Court action is the only option - how long and how much?

Knee jerk issuing of court actions can mean you have a “tiger by the tail” leaving you open to counterclaims and large costs. Develop a clear enforcement strategy from the outside and consider how to achieve it in the fewest moves. Seeking urgent injunctive relief may be appropriate in serious cases.

- 6. Complaints - deal fairly but resolve quickly

Ensure that your Complaints and Collections teams work in tandem with each other. A customer complaint isn’t always a good reason to put enforcement action on hold. Treat each customer and each complaint on a case by case basis to develop a joined up strategy to achieve a satisfactory, well documented outcome for all.

- 7. Don't just focus on your defaulting customer...

Are your Collections and Recoveries teams trained to spot trends i.e. satisfactory quality claims relating to the same supplier/asset type, suspicious broker activity or linked defaulting customers? It may be worth you considering claims against 3rd parties to recover large exposures and to ensure you reflect the lessons learned from this time into future credit practices.

Contact Us

If you would like a more detailed conversation on ways we can help you, or help train your teams to prepare, please get in touch.