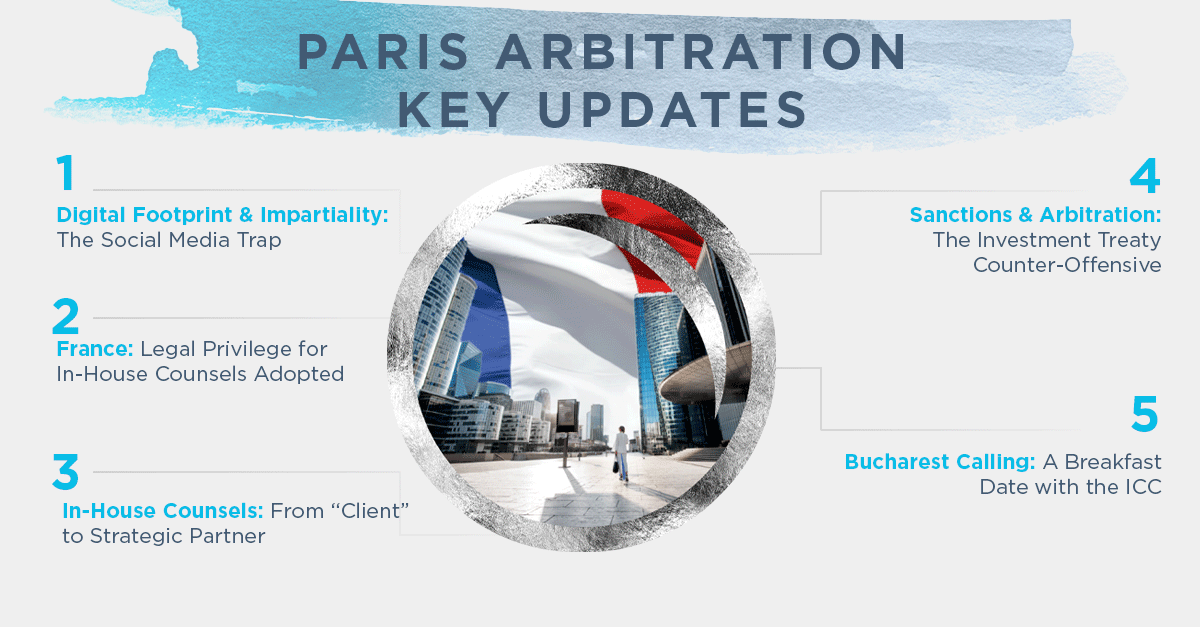

Welcome to our latest update, focused on bringing you closer to the pulse of arbitration in Paris. In this edition we have curated key arbitration points that we believe are important for you:

Enjoy the read! Please do get in touch if you have any feedback or questions.

Ioana

Latest French arbitration case law

Impartiality, digital footprint & tribunal constitution: On 15 January 2026, the Paris Court of Appeal set aside a PCA partial award in Russia v. Akhmetov, offering a striking reminder of how strictly French courts police the constitution of arbitral tribunals and the appearance of arbitrator impartiality.

The dispute concerned the alleged expropriation of luxury real estate in Crimea following the 2014 annexation. Russia sought annulment of the award, arguing that the tribunal was irregularly constituted. The Court agreed on two fronts. First, it found that the tribunal had ignored a binding agreement between the parties regarding the specific method for appointing the President. Second, the Court addressed the President’s impartiality. It held that a firm-wide statement from the arbitrator’s law firm condemning the invasion of Ukraine, combined with the arbitrator’s own social media “likes” of anti-Russian posts, created a “reasonable doubt” as to his neutrality.

Takeaway? This decision confirms that an arbitrator’s duty of independence and impartiality now extends beyond the hearing room and is inextricably linked to their digital persona. The Court has made it clear: social media activity and firm-wide public stances are not “private” matters – they are objective facts that can lead to the annulment of an award.

(Read my analysis of the Court of Appeal’s decision here)

Regional highlights – France: legal privilege for in-house counsels adopted

After more than thirty years of debate and several false starts, France has finally crossed the Rubicon. On 14 January 2026, the French Senate definitively adopted the Loi Terlier, a landmark text establishing a “legal privilege” for in-house counsels. By introducing a regime of confidentiality for internal legal advice, the reform aims to bolster the competitiveness of French companies and protect their legal security in an increasingly litigious global landscape. This move brings France in line with most OECD countries and carries significant implications for French companies:

- The end of the “Serpent de Mer”: The Senate’s final vote (196 in favor, 125 against) marks the end of a long-standing legislative saga. Supported by Rapporteur Louis Vogel, the law effectively creates a new Article 58-1 in the 1971 Act on legal professions. The primary goal is to allow companies to conduct candid internal risk assessments without the fear that these very analyses will be “weaponized” against them in future civil or commercial disputes,

- The “Five Commandments” for confidentiality: The protection is not automatic. To benefit from confidentiality, the opinion must (i) be drafted by a jurist holding a Master in Law (or equivalent), (ii) who has undergone specific ethics training, (iii) be intended exclusively for the company’s management or group organs, (iv) consist of a legal opinion or advice based on a rule of law, and (v) bear a specific mandatory confidentiality header,

- Limitations: The confidentiality shield is deliberately circumscribed: it will not apply in criminal or tax matters, nor to authorities of the European Union exercising their investigatory powers. A judicial procedure is provided to lift confidentiality where justified, thereby balancing corporate legal security with the needs of transparency and public enforcement,

- A strategic shield in international arbitration: This reform may be a game-changer during the document production phase. In France-seated arbitrations, parties frequently struggle with the “asymmetry” of privilege between common law and civil law jurisdictions. The new law provides a strong basis for companies to resist the disclosure of internal strategy memos or compliance assessments in civil and commercial proceedings – thus “leveling the playing field” against broad discovery requests from foreign adversaries,

- Debate over competitiveness and fairness: Proponents – including business associations such as the AFJE – herald the reform as reinforcing legal certainty and competitiveness for French companies. Critics, notably the National Council of Bars (CNB), have argued that the regime primarily benefits larger corporations and risks reducing transparency for third parties in disputes or compliance investigations,

- Next steps: Unless challenged before the Conseil constitutionnel, the law will be promulgated shortly and enter into force by decree within the next 12 months, requiring corporate legal teams and companies to adapt internal practices to the new confidentiality framework.

Practical tips – In-house counsels: from “client” to strategic partner

In the traditional view of arbitration, the in-house counsel is often seen as the “client” – the one who hires the external team and waits for the final award. Far from being passive recipients of advice, the legal department is in reality the “co-pilot”, acting as strategic coordinators, information managers, and translators between legal complexity and business reality. Its day-to-day involvement can be the difference between a technically sound legal victory and a commercially successful outcome.

Here is how to strategically calibrate your involvement as in-house counsel once the proceedings are underway:

- The “Dominus” of strategy: While external counsel are the “doers” who establish the technical legal path, in-house counsel must act as the ultimate validator of the final strategy. You are responsible to management for the outcome of the arbitration and must ensure the legal path aligns with the company’s broader business and financial targets,

- To CC or not to CC?: Most institutional rules allow any party representative to be included in communications between lawyers and the Tribunal. While the decision ultimately rests with the client, the advantage of being copied on all correspondence is that you are timely and fully apprised of the proceedings and ongoing discussions. Of course, avoid replying directly to the tribunal or opposing counsel!,

- Master document management: External counsel are only as good as the evidence they receive. You should lead the collection of documents as you know which files or evidence hold the keys to the case. Maintaining well-organized records is essential to sustain the company’s narrative,

- Anticipate witnesses: In-house counsel must identify key fact witnesses at the earliest possible stage. Crucial employees may retire, move to competitors, or even be hired by the opposing party. These risks should by anticipated by composing teams of several team members, ensuring they are all informed of the ongoing project, that they have the history of the project and can locate the relevant documents ,

- Should you attend the hearing?: Absolutely! Your presence as a “party representative” sends a powerful message of involvement to the Tribunal and the counterparty. More practically, you are the ultimate “fact checker”: you can supply additional information in real-time, and you are the only one who can make calls on settlement if needed,

- Bridge the boardroom: Your most critical procedural role is internal coordination. You should act as a project manager by translating complex legal developments into actionable business guidance for your senior management. By regularly keeping in touch with external counsels and procedural correspondence, establishing a transparent approach – through regular briefings rather than last-minute updates – will prevent surprises and help leadership make informed, timely decisions regarding settlement, financial reserves, etc.

Sectorial news – Sanctions & arbitration: the investment treaty counter-offensive

For decades, economic sanctions were viewed primarily as tools of diplomatic pressure – sharp, yet surgical instruments of foreign policy. However, the unprecedented scale of measures taken since 2022 has transformed sanctions into a high-stakes legal battlefield. We are now witnessing what some even describe as the “undoing of international investment arbitration”: a direct collision between the mandatory nature of public law sanctions and the private protections of investment treaties. With over 24 publicly known sanctions-related ISDS claims now totaling a staggering US$62 billion, the “sanctions-shield” of Western states is being tested by a massive treaty-based counter-offensive:

- The EU’s 18th package & the “anti-arbitration” shield: Adopted in July 2025, the EU’s 18th sanctions package introduced (i) a “no-claims” regime explicitly prohibiting the recognition or enforcement of any ISDS award arising from sanctions-related measures, and (ii) a “clawback” rule, granting Member States a legal right to recover any damages or legal costs incurred in such arbitrations directly from the investors through their own domestic courts,

- Switzerland aligns with the EEA: Switzerland, on 29 October 2025, aligned its sanctions framework to mirror the EU’s 18th package, by blocking enforcement of sanctions-related awards rendered outside the EEA and introducing a clawback for legal costs. Simultaneously, it faced its first treaty claim based on sanctions, with Gulnara Kerimova filing a hundreds-of-millions UNCITRAL claim under the 1990 USSR-Switzerland BIT over frozen real estate,

- The Euroclear storm in Belgium: In September 2025, four non-sanctioned Russian nationals sent “trigger letters” threatening investment treaty claims against Belgium under the 1989 USSR-BLEU BIT over assets frozen at Euroclear. This escalation led Prime Minister Bart De Wever to demand “irrevocable guarantees” from the EU to shield Belgium from the potential liability of a wave of multi-billion dollar claims,

- High-stakes claims: The scale of the litigation is unprecedented. Mikhail Fridman is currently pursuing a US$16 billion claim against Luxembourg for freezing his assets (as well as against the UK), while Belarusian state-owned Belaruskali is seeking US$12 billion from Lithuania over a terminated fertilizer transport contract, France faces a claim from Russo-Armenian tycoon Samvel Karapetyan following the seizure of his Côte d’Azur estate over alleged money laundering ties to sanctioned giant Gazprom – among others,

- More threats: A new wave of threats is putting Western states on notice. Rosneft has threatened to sue Germany for US$7 billion over the ongoing trusteeship of its interests in refineries, while Igor Makarov has threatened to bring a US$250 million claim against Canada, arguing that the refusal to take him off its sanctions lists, despite his renunciation of Russian citizenship, constitutes a breach of the Canada-Moldova BIT – which shows how sanctions lists themselves are becoming the basis for “indirect expropriation” arguments.

In the sanctions context, arbitration is being therefore increasingly caught in a legal and political crossfire, and we are witnessing a transformation of the traditional investment protection regime in the face of geopolitical necessity.

By the way

If Paris is the “home” of international arbitration, I’ve always believed that its heart beats wherever practitioners gather to connect and share together! For me, that “bridge” is never more important than when it connects us with peers, leading experts and top-level representatives.

That’s why I am particularly excited to invite you to the 2nd ICC Arbitration Breakfast Romania on 18 March 2026! Following the success of our 2025 inaugural edition, my co-host Sebastian Gutiu and I will be welcoming the community to the beautiful Marmorosch Bucharest for a morning of strategic discussion. We will be diving the “nitty-gritty” of tribunal constitution and arbitrator selection, as well as the evolving landscape of provisional measures (including by emergency arbitrators).

Space is limited and tends to fill up quickly, so let me know if you’d like to join! Consider this also a wonderful excuse to visit the “Little Paris of the East”, which has been my home for so many years!