(2 min read)

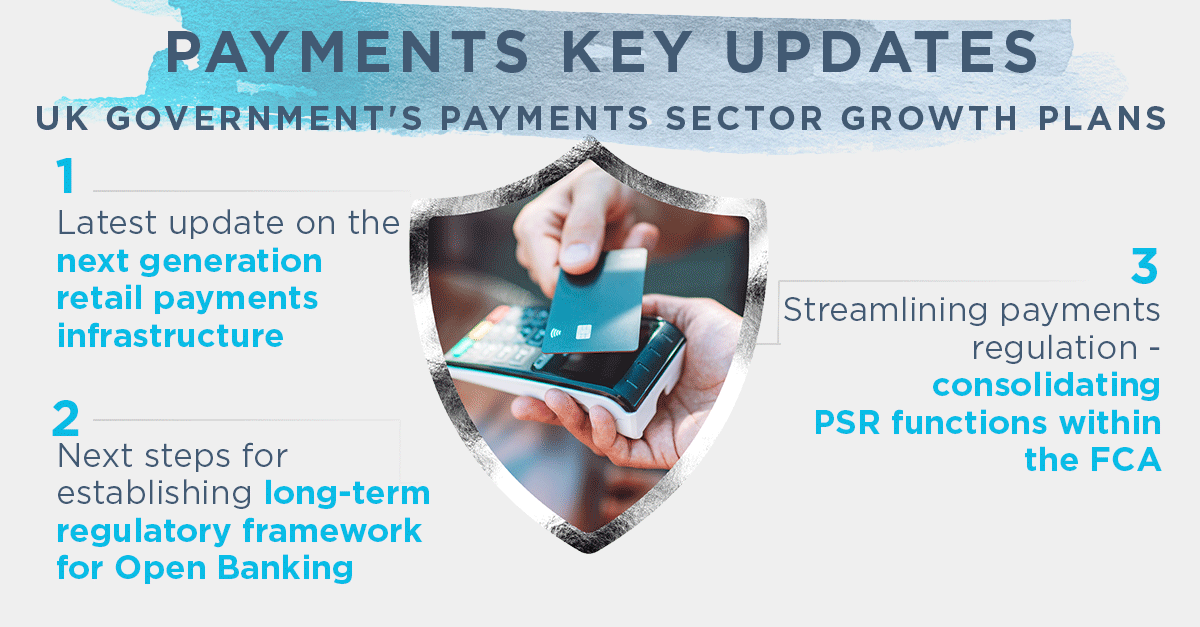

The UK Government is committed to supporting economic growth through a modern payment services sector, as set out in its National Payments Vision (NPV). To deliver NPV’s goals, the Payments Vision Delivery Committee (PVDC) is developing the strategy for next-generation retail payments infrastructure, keeping the UK at the forefront of payment technology. Alongside this, the Government is advancing a sustainable regulatory framework for Open Banking and smart data schemes. A major change is also the integration of the Payment Systems Regulator (PSR) into the Financial Conduct Authority (FCA), streamlining oversight and regulation. In this issue we discuss these initiatives, which aim to drive innovation and competition, improve regulatory clarity and efficiency, and enhance consumer protection in the UK payments sector.

The UK Government is committed to promoting economic growth by ensuring the UK economy is supported by a modern and robust payment services sector, that is a global leader, as outlined in its National Payments Vision (NPV). This strategy encompasses several key objectives, including enhancing the resilience and efficiency of the payments ecosystem, fostering innovation to meet evolving consumer and business needs, and bolstering security and trust in payment systems through close collaboration with the financial sector.

To achieve these goals, the Government has set up the Payments Vision Delivery Committee (PVDC) which is now working on the strategy and vision for the “next generation retail payments infrastructure”, ensuring that the UK remains at the forefront of technological advancements in payments.

This is in addition to the UK forging ahead with its plans to establish a sustainable long-term regulatory framework for Open Banking and other smart data schemes.

At the same time as we see new arrangements being put in place to help build and achieve the aims of the “vision”, the Government is implementing a more cohesive and efficient regulatory framework. The significant change is the integration of the Payment Systems Regulator (PSR) into the Financial Conduct Authority (FCA). This integration aims to streamline oversight and create a unified approach to regulation.

Read our insights here on these ongoing initiatives and the possible impacts on relevant firms and next steps.

Upcoming events

For information on our upcoming training events including our Regulatory Essentials programme, please visit our Financial Regulation page.

Next steps

If you want to find out what these updates mean for your business, or discuss training opportunities or systems and controls changes, please feel free to get in touch with our Payments and Data Protection teams who would be delighted to speak to you.