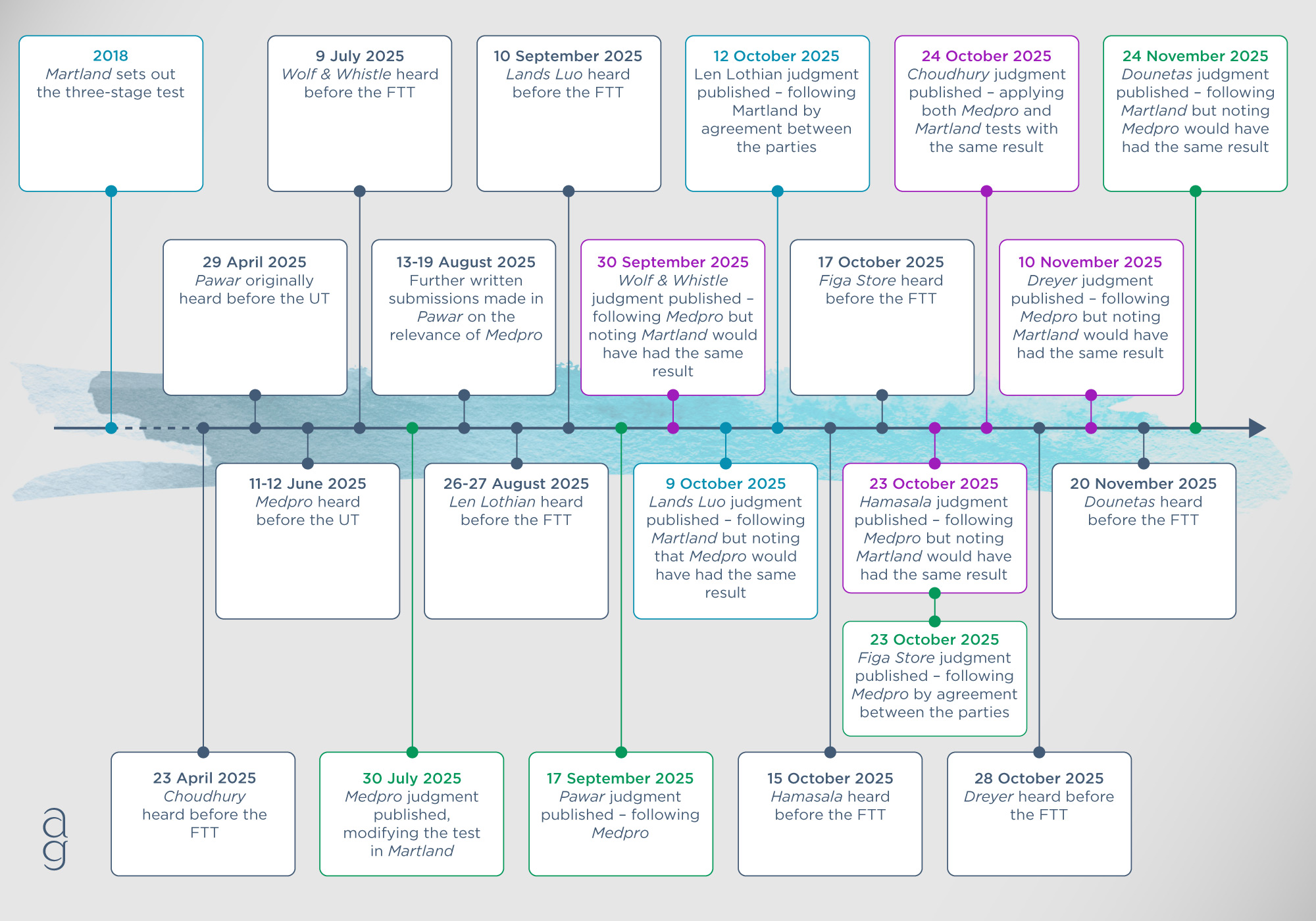

It is important that taxpayers comply with the procedures set out in legislation and that the procedure rules are followed closely wherever possible. However, if you have missed a deadline, all is not lost as there are, generally, opportunities to apply late. In some cases HMRC can allow a late appeal, but the Tribunal may also grant permission to appeal if it considers it necessary to deal with the case fairly and justly, a test which has been the subject of some judicial dispute. The Tribunal has historically considered these applications by reference to the test set out in Martland v HMRC [2018] UKUT 178 (TCC) (Martland) but a number of recent Tribunal decisions suggest that the factors to be considered may be more evenly balanced than previously understood.

Click here to see the timeline >

2018: The “Martland Test”

In Martland, the Upper Tribunal set out a three-stage test for considering whether to grant permission for an appeal that is out of time. The three stages are:

1. The Length of the Delay.

The Tribunal first considers how long the delay in filing the appeal was and assesses whether the delay was significant.

2. The Reasons for Default.

Next, the Tribunal examines the reasons for the delay, and evaluates whether the appellant had good reason for not acting within the time limit.

3. The Circumstances of the Case.

Finally, the Tribunal will balance the merits of the appeal against the potential prejudice which would be caused to both parties if permission were granted or refused. The Upper Tribunal in Martland emphasised that this balancing exercise should give special weight to the need for efficient conduct of litigation and adherence to statutory deadlines.

2025: Medpro’s impact on the Martland Test

In July this year, the Upper Tribunal endorsed the Martland test, in Medpro Healthcare Ltd. v HMRC [2025] UKUT 255 (TCC) (Medpro). However, the Upper Tribunal ultimately diverged from Martland’s approach, stating that when considering stage three of the Martland test, time limits are important but there is no legal basis for concluding that they should take precedence over the merits of the case.

Judgments of the Upper Tribunal are binding on the First-tier Tribunal but, while it will regard them as highly authoritative, the Upper Tribunal is not bound by its own decisions. The tests as set out in Martland and Medpro are on an even footing, with neither taking precedence over the other.

Since Medpro, the Tax Tribunals have taken a varied approach to the Martland test, generally considering both cases, some showing a preference for one test over another.

Application of the Medpro Test

The key authority for following the Medpro formulation of the test is Tajinder Pawar v HMRC [2025] UKUT 00309 (TCC) (Pawar). Having originally dismissed Mr Pawar’s appeal on its three original grounds, the Upper Tribunal was asked to consider a late fourth ground, based on the Medpro decision and its impact on observing time limits for allowing a late appeal.

Pawar concerns a significant VAT penalty imposed on First Stop Wholesale Ltd due to errors in the company’s VAT returns. In October 2017, HMRC issued Mr Pawar, who was both a director and shareholder of the company, with a personal liability notice holding him wholly and personally liable for the penalty and upheld the penalty in late 2018. In 2022, more than 3 years after the 30-day deadline, Mr Pawar applied to the First-tier Tribunal for permission to bring a late appeal. The First-tier Tribunal, applying stage 3 of the Martland test and taking account of the length of the delay, refused permission for the late appeal. Mr Pawar appealed the decision to the Upper Tribunal.

The decision in Pawar centres on this fourth ground of appeal and whether the Tribunal should follow the authority of Martland, which stated that particular emphasis should be placed on observing statutory time limits, or Medpro, which held that while observing time limits is important, it is not a factor that should overshadow the merits of the case.

The Upper Tribunal reasoned that Medpro was a more recent decision and a decision which expressly considered the Martland test. The Upper Tribunal therefore set aside the First-tier Tribunal decision and remade it, balancing the merits of the delay against the potential prejudice to Mr Pawar, if his appeal was dismissed, and to HMRC if it was granted, without giving special weight to the need to observe time limits.

The Upper Tribunal nonetheless found that, even without according special importance to the need for statutory time limits to be respected, the prejudice to Mr Pawar of the appeal being dismissed was not sufficiently great as to outweigh an unjustified delay of more than 3 years. The Upper Tribunal therefore dismissed the appeal.

Pawar therefore affirmed the Medpro approach. One might expect the First-tier Tribunal to adopt Medpro going forwards, given it is both the most recent approach and the approach confirmed by the Upper Tribunal in Pawar (having had the opportunity to consider both Medpro and Martland). However, a proliferation of recent First-tier Tribunal decisions has made it difficult to discern any single approach.

The First-tier Tribunal’s approach since Pawar

Late 2025 has seen a deluge of ‘late’ appeal decisions by the First-tier Tribunal.

In Lands Luo Limited v HMRC [2025] UKFTT 1207 (TC) (Lands Luo), the First-tier Tribunal acknowledged the tension between Martland and Medpro but quickly discounted it: “We should state immediately that we doubt that the difference in the approach to the test to be applied to determine whether to grant permission to bring a late appeal between Martland and Medpro is likely to lead to different results in many cases. This is because when it comes to evaluating all the circumstances of the case, factors specific to the case are always likely to determine the outcome” (para 70).

The same ambivalence appears in Choudhury v HMRC [2025] UKFTT 1274 (TC) (Choudhury), which was heard prior to the judgments in Medpro, Pawar and Lands Luo. The First-tier Tribunal acknowledged these later decisions but nonetheless felt it unnecessary to seek further representation from the parties, having satisfied itself that it would have reached the same conclusion under both Medpro and Martland tests.

This uneasy balance may be sustainable for so long as the Tribunal can satisfy itself that both tests would, on the facts, result in the same outcome. However, if the tests were to result in conflicting outcomes, it is not certain which would prevail. The First-tier Tribunal in Lands Luo ultimately favoured Martland on the basis that it was consistent with the approach of the Court of Appeal in BPP Holdings v HMRC [2017] UKSC 55, which was affirmed or permitted by the Supreme Court. The First-tier Tribunal panel in Lands Luo was larger than usual, particularly for this type of hearing, and notably included Dingeman LJ, the Senior President of Tribunals. However, despite the seniority of its panel the decision is ultimately of limited assistance as it makes no reference to the judgment in Pawar. A similar preference for Martland was shown more recently in Dounetas [2025] UKFTT 1416 (TC) (Dounetas) in which case the First-tier Tribunal referred to Medpro but acknowledged it was under appeal.

Conversely, in each of Wolf & Whistle Limited v HMRC [2025] UKFTT 01187 (TC) (Wolf & Whistle) (heard before the Pawar judgment), Hamasala v HMRC [2025] UKFTT 01261 (TC) (Hamasala) and Dreyer v HMRC [2025] UKFTT 01336 (TC) (Dreyer) (both heard after the Pawar judgment) the First-tier Tribunal applied Medpro but noted that it would have reached the same decision had it applied the stricter test in Martland.

HMRC’s view

It is not clear whether HMRC has a settled internal view on which is the correct test. In Len Lothian Holdings Limited [2025] UKFTT 01254 (TC) (Len Lothian), HMRC agreed with the taxpayer that the First-tier Tribunal should apply the test as set out in Martland. However, although Len Lothian was heard after the judgment in Medpro, it was heard before the judgment was handed down in Pawar. By contrast, in Figa Store Limited v HMRC [2025] UKFTT 1260 (TC) (Figa Store), which was heard after the judgment in Pawar, the parties agreed that the First-tier Tribunal should apply the test as adjusted by Medpro; and similarly in Dounetas it was HMRC that sought to bring the Medpro authority into the appeal at the hearing. It is unclear whether this represents a change in HMRC’s stance following Pawar or merely indicates a lack of consistent approach with HMRC preferring one or the other when it best suits their circumstances.

Practical takeaways

Fortunately, we understand that Medpro has been appealed, so the question of whether special weight should be given to observing time limits should be resolved authoritatively by the Court of Appeal.

For now, the case law suggests that the First-tier Tribunal is prepared to follow the approach set out in Medpro in seeking to ensure a fair balance between procedural integrity and the merits of the appeal. As a result, the merits of late appeals to the First-tier Tribunal may be given greater consideration than they might have previously. However, this is not certain and it is notable that no decision to date has found the outcome of Medpro or Martland would be different. Until we have definitive guidance from a higher court, it is possible that, faced with a fact pattern that results in different outcomes depending on which test is applied, a Tribunal could prefer the approach set out in Martland without the Medpro modification.

Anyone considering a late appeal should ensure they have strong reasons for the delay and should make clear in submissions any potential prejudice they would suffer if the appeal is not allowed.

![FTT Bars HMRC for Procedural Failures - Carbon Six Engineering Ltd v HMRC [2026] UKFTT 177 (TC)](/globalassets/insights/white-with-accent/teaser---building.jpg)