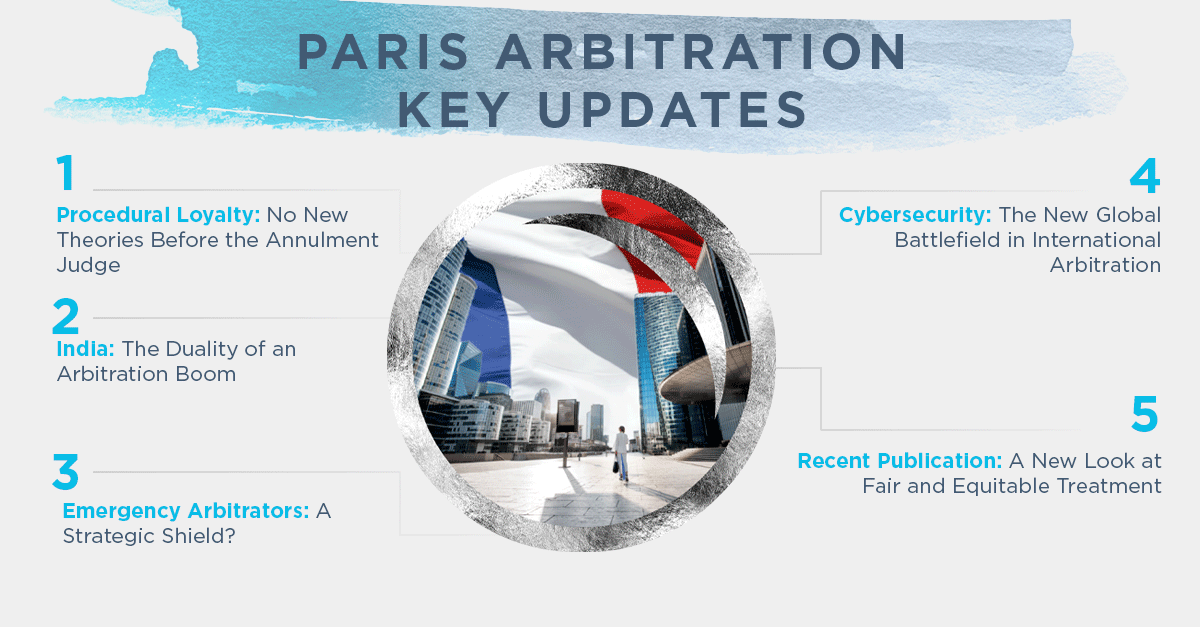

Welcome to our latest update, focused on bringing you closer to the pulse of arbitration in Paris. In this edition we have curated key arbitration points that we believe are important for you:

Enjoy the read! Please do get in touch if you have any feedback or questions.

Ioana

LATEST FRENCH ARBITRATION CASE LAW

PROCEDURAL LOYALTY & JURISDICTION: On 30 September 2025, the Paris Court of Appeal addressed the limits of legal argumentation during annulment proceedings, specifically ruling on whether a party may introduce a new jurisdictional theory before the annulment judge that differs entirely from the one argued before the arbitral tribunal.

The case followed an ICC award in which the tribunal declined jurisdiction over a dispute between Italian contractors (including Astaris and Webuild) and Venezuela regarding a railway project. Before the Court, the contractors shifted their jurisdictional strategy: rather than relying on a unilateral offer to arbitrate in the Italia-Venezuela BIT (as argued during arbitration), they contended that the treaty created a contractual bond extending to Venezuela because of its involvement in performing the contracts. The Court declared this ground inadmissible under Article 1466 of the French CPC. It held that this “radical shift in argumentation” – relying on a different offer to arbitrate than the one debated before the arbitrators – constituted a breach of procedural loyalty.

Takeaway? This decision serves as a stern reminder that annulment proceedings are not a “second bite at the apple”. Parties are precluded from rewriting their jurisdictional story before the Court by introducing new legal theories that could, and should, have been raised before the arbitral tribunal.

(Read my analysis of the Court of Appeal’s decision here)

REGIONAL HIGHLIGHTS – India: the duality of an arbitration boom

India is rapidly emerging as a global “arbitration hub”, fueled by a US$1.7 trillion infrastructure commitment and a particularly proactive legislative agenda. This surge in high-value, complex projects makes India a hot topic for international arbitration, while domestic reforms aiming to minimize judicial intervention have made arbitration a hot topic within India itself. This transformation, however, presents a unique ambivalence: while the judiciary and legislature push for pro-arbitration standards to attract FDI, recent governmental pushback in public contracts create a nuanced landscape for global investors:

- Legislative modernization: Recent legislative changes show a clear shift in policy toward making arbitration more efficient and reliable in India. The newly enacted Arbitration Act 2025 – which has received “Royal Assent” and is viewed by the market as India’s most significant arbitration reform in a decade – notably aims at reducing judicial intervention, boosting institutional arbitration (to decrease the historical reliance on ad hoc proceedings), and establishing appellate arbitral tribunals for certain challenges,

- Domestic institutionalization: This legislative push is strongly supported by the growth of domestic institutions, like the Mumbai Centre for International Arbitration (MCIA), which reported a 48% increase in new cases in 2024, with almost 91% of awards finalized within 18 months (none of them being set aside by courts). Internationally, the opening of the PCA’s office in New Delhi in September 2024 has further cemented India’s status as an international arbitration venue,

- Judicial support for arbitral autonomy: A string of Supreme Court decisions in 2024-2025 has reshaped practice: the Court has notably clarified that (i) courts have a limited power to modify arbitral awards under the 1996 Arbitration & Conciliation Act (Gayatri Balasamy v ISG Novasoft), and that (ii) a court’s role is narrowly limited to examining the prima facie existence of an arbitration agreement, with questions of fraud and fact being reserved for the arbitrator (Goqii Technologies v Sokrati Technologies),

- Government vs public sector arbitration: While the general climate is pro-arbitration, friction persists in public sector disputes. Following the Supreme Court’s rare setting aside of the award in Delhi Metro Rail Corporation v. DAMEPL, the Ministry of Finance issued guidelines in June 2024 discouraging arbitration in large public procurement contracts in favor of mediation. In April 2025, the Delhi Public Works Department also decided to delete arbitration clauses from future PWD contracts – thus highlighting a critical tension between India’s global ambitions and the country’s reluctance to accept adverse high-stakes awards,

- Investment treaty reset: India is in the process of revamping its 2016 Model BIT, with the 2024-2025 Budget announcing a shift toward a more balanced and “investor-friendly” model. New BITs signed in 2024 with Uzbekistan and the UAE already depart from the restrictive 2016 template by expanding the definition of “investment” and re-including portfolio investments – a notable policy reversal that shows India’s desire to “encourage sustained foreign investment and in the spirit of ‘first develop India’”.

PRACTICAL TIPS – Emergency arbitrators: when and how to use them

The period between filing a Request for Arbitration and the constitution of the arbitral tribunal is often the most vulnerable time for a party, leaving assets or evidence exposed to dispersal. While domestic courts have traditionally filled this void, Emergency Arbitrator (EA) provisions are now a standard feature of major institutional rules, offering a swift and neutral alternative. However, EA is not a “one-size-fits-all” solution; it requires a careful strategic assessment of urgency, enforceability, and cost.

Here is what you need to know before pulling the trigger on an EA application:

- Why and when to appoint? EA is preferable to domestic courts when you need to preserve confidentiality or avoid the unpredictability of local jurisdictions. Speed is the essence of the procedure: appointments are made within 24 hours under SCC and SIAC rules, 2 days under ICC rules, and 3 days under LCIA rules. Rules like the ICC even allow you to file for EA before the Request for Arbitration (provided you still file the latter within 10 days),

- High threshold for relief: EAs have broad discretion to set procedure (often deciding on documents only), but the burden of proof is high. You must demonstrate urgency (harm cannot wait for the main tribunal), a risk of irreparable harm (often interpreted as serious/substantial harm not adequately compensable by damages), and a prima facie case on the merits,

- What can you get? EAs have wide discretion to order any interim relief necessary, typically orders to preserve assets, maintain the status quo, or preserve evidence. However, unlike courts, EAs generally cannot grant ex parte relief, as most rules require notifying the respondent (to ensure due process). Decisions are usually rendered within 15 days for ICC/CIETAC/Swiss Rules, 14 days for LCIA/SIAC/HKIAC, and 5 days for SCC,

- Investment treaty disputes: Proceed with caution, issues of State sovereignty and consent make this complex. A major hurdle is often the treaty’s “cooling-off” period: if the EA is filed before this period expires, tribunals may struggle with jurisdiction (although some EAs have allowed it to prevent futile waiting periods),

- Will it be enforced? This is the main risk as enforceability varies: while expressly recognized in Singapore and Hong Kong, uncertainty remains elsewhere under the New York Convention as EA decisions are often not considered “final”. However, voluntary compliance is high, as parties fear negative repercussions from the future tribunal,

- Strategy check: Before filing, ask yourself: “Is the risk truly imminent?” If the harm can wait a few months for the full tribunal, an EA application may be an expensive dismissal (the ICC, for example, requires a US$ 40,000 advance). If it can’t wait, the EA is a powerful tool to lock in the status quo.

SECTORIAL NEWS – Arbitration & cybersecurity: the new battlefield

The exponential rise in cyber incidents – from sophisticated ransomware to global IT outages – has turned cybersecurity into one of the most strategically significant sources of disputes for companies worldwide. As critical infrastructure, financial institutions, life sciences, energy, and technology companies become more interconnected, the boundaries between the “physical” and “digital” worlds have effectively disappeared. Unsurprisingly, cyber events now generate high-value commercial claims, regulatory investigations, and even treaty claims – increasingly positioning arbitration as the forum of choice to resolve the complex, cross-border disputes arising from cyber crises.

- Typology of disputes: Cybersecurity and data privacy have emerged as the number one dispute risk for businesses heading into 2025. Typical cyber-related disputes include breaches of data protection regulations, supply-chain disruption following cyber incidents, business interruption losses, insurance coverage disputes, and cross-border regulatory enforcement. Sectors such as financial institutions (66%), technology (56%), healthcare and life sciences (46%) all cite cyber as their top expected dispute type,

- Regulatory tightening: 2024-2025 saw a wave of significant regulatory reforms to uphold cybersecurity over critical sectors. In the EU, the NIS2 Directive and the Cyber Resilience Act have set strict new standards. Singapore significantly expanded its oversight with the Cybersecurity (Amendment) Act 2024, covering “Systems of Temporary Cybersecurity Concern”. Meanwhile, the US has ramped up enforcement through the SEC’s disclosure rules and the Cyber Incident Reporting for Critical Infrastructure Act (CIRCIA),

- Cyber in armed conflict: “War-bitration” is becoming a reality as cyberattacks are increasingly used in hybrid warfare. Disputes are emerging, for instance, over attribution (state-sponsored vs. criminal) and the applicability of “war exclusions” in insurance policies. These incidents complicate the arbitral process, particularly regarding the legality of ransom payments under sanctions regimes and the preservation of evidence in conflict zones,

- Attribution challenges and forensic evidence: Proving who was behind a cyberattack (attribution) remains one of the greatest challenges to establishing liability. Arbitral tribunals rely heavily on highly specialized cyber forensic experts whose technical evidence is central to determining the scope of the attack and assessing damages. This reliance necessitates strict e-discovery protocols to handle vast volumes of sensitive, cross-border data, including source code and trade secrets,

- Recent arbitration cases: Recent cases illustrate how cybersecurity obligations can trigger arbitration or treaty-based disputes. For example, in late October 2025, Huawei sent a letter to members of the Polish government for a potential billion-dollar ECT claim, challenging a forthcoming law that seeks to restrict the use of “high-risk” telecommunications suppliers based on national security concerns.

- Recommended listening: For a deeper dive into the real-world actors behind these types of disputes, I strongly recommend the BBC podcast “Cyber Hack”. The latest season, Evil Corp, investigates a Russian cyber gang accused of stealing hundreds of millions of dollars, while the prior season The Lazarus Heist dissects North Korea-linked hacks such as the Sony breach and the Bangladesh Bank heist. A truly fascinating listen!

BY THE WAY

They say you never forget your first love! In the legal world, mine is undoubtedly the Fair and Equitable Treatment (FET) standard. As many of you know, this topic has been my “marotte” since my days writing my thesis and my 2008 OUP book.

I was therefore delighted to revisit this ever-evolving standard in the Routledge Handbook on International Economic Law, just published last month. My chapter “Fair and Equitable Treatment and Its Interactions with Other Standards of Treatment” aims to act as a practical compass for practitioners navigating the “fog” of this controversial concept, exploring how its boundaries are constantly redrawn by tribunals.

Consider this chapter a teaser before the main course: I am currently dotting the i’s and crossing the t’s on the second edition of my book, The Fair and Equitable Treatment Standard in International Foreign Investment Law, coming your way in 2026. Until then, I hope this Handbook chapter makes for an insightful read – let me know your thoughts!