CHANGES ARE AFOOT IN THE UK'S ESG REGULATION. THE FCA IS CONSULTING ON A SUSTAINABILITY LABEL OPT-IN REGIME, NEW DISCLOSURES AND AN ANTI-GREENWASHING RULE. PRIVATE FUND MANAGERS WILL WANT TO PAY CAREFUL ATTENTION TO THE PROPOSALS.

Private fund managers in the UK may be able to utilise a forthcoming sustainability label opt-in regime for in-scope UK investment funds in light of a recent consultation paper (the CP) published by the FCA.

And the FCA has signalled that it is considering ultimately extending the regime to non-UK domiciled investment funds managed by non-UK fund managers.

Fund managers will no doubt be familiar with the EU's Sustainable Finance Disclosure Regulation (SDFR) and Taxonomy Regulation, as well as the latest U.S. Securities and Exchange Commission (SEC) proposals for requirements relating to sustainable investment funds. The FCA's Sustainability Disclosure Requirements (the SDR) represents the UK's version of these regimes, albeit with a different approach and set of requirements which aim to build trust and integrity in ESG-labelled instruments, products and the supporting ecosystem[1].

The FCA plans cover two areas: The FCA will introduce sustainable investment labels and associated disclosure requirements. This will be an-opt-in regime with specific disclosure requirements applying at fund and firm level where a fund manager opts in regarding a fund it manages. For firms and funds not opted in, there will be naming and marketing restrictions. Secondly, the FCA is set to bring in a general anti-greenwashing rule.

We provide some initial thoughts looking at these proposals from the point of view of private fund managers managing or marketing private funds in the UK.

- I am a UK private fund manager – how might the proposed rules apply to me?

A UK private fund manager will typically be a UK AIFM (either a full-scope UK AIFM or a small-authorised UK AIFM) or an investment firm under the UK's regulatory system. The rules on labelling and related disclosures will apply to these firms, if they choose to opt-in. And even where a firm does not opt-in there are still some mandatory requirements in certain situations.

Furthermore, the anti-greenwashing rule will apply to any UK authorised firm.

- I am a non-UK private fund manager and market my non-UK funds in the UK – do the proposed rules apply to me?

The SDR proposals do not consider non-UK AIFMs and the AIFs under their management, such as those domiciled in the Cayman Islands, Ireland or Luxembourg, as in-scope. The FCA intends to follow up on the CP with a separate consultation as to how the proposals may apply in respect of overseas funds in due course – in the meantime, we would recommend non-UK AIFMs managing such funds continue to keep both the proposed SDR regime and FCA's wider ESG Strategy under close review. Technical application aside, such managers will also be mindful to evolving market expectations of investors that may demand application of the disclosures whether strictly required or not.

- Even if I choose not to opt-in to the regime, are there any mandatory requirements that might apply to me?

Yes, fund managers should be aware that even where a fund chooses not to use (or does not qualify for) one of the new labels, it may still have to produce certain SDR compliant disclosures where sustainability characteristics are a central part of the fund's investment policy or strategy.

- Do the new requirements matter if you are not marketing to UK retail investors?

In short, yes – institutional investors are also included within the scope of the proposals.

The new rules would require a shorter set of standardised disclosures if sold to retail investors. These disclosures would not be applicable if marketing is restricted in relation to retail investors.

However, the new rules also contain requirement for longer form disclosures that are primarily aimed at institutional investors, both in the form of fund level pre-contractual disclosures and periodic sustainability products reports. The exact requirements will different depending on whether a fund has chosen an investment label and/or has sustainability related features (regardless of whether a label is chosen).

Finally, detailed entity level disclosures bite on firms with AuM of £5 billion (including firms that only market funds in scope to non-retail investors), There will be a phased implementation of these disclosure requirements that will depend on the AuM of the firm.

Further, the FCA is proposing general "anti-greenwashing rules", which would apply to all FCA authorised firms, within the ESG sourcebook of the FCA Handbook of Rules and Guidance. The FCA considers that its anti-greenwashing proposals "[clarify] existing rules" and as such, would come into force immediately upon the publication of the final Policy Statement around 30 June 2023 – the CP particularly highlights the following:

"A firm (whether it is undertaking sustainability in-scope business or not, including firms that approve financial promotions for unauthorised persons) must ensure that any reference to the sustainability characteristics of a product or service is:

(1) consistent with the sustainability profile of the product or service; and

(2) clear, fair and not misleading."

By comparison, fund managers marketing to retail will also have to consider the CP's naming and marketing restrictions regarding in-scope products that do not qualify for and use one of the proposed labels (e.g. prohibiting such products from using terms such as 'net zero', 'ESG' or 'sustainable'). The FCA has also highlighted the relevance of the forthcoming Consumer Duty (CD) across its proposals – indeed, any fund manager looking to market an in-scope fund to retail investors will have to comply with an extensive range of regulatory requirements under both the SDR and CD regimes.

- In light of the above, what proposed labels are available for in-scope funds?

The CP proposes an opt-in (i.e. non-mandatory) labelling regime offering three categories for in-scope investment funds which meet certain qualifying criteria:

- "Sustainable focus" (for funds investing in assets that are environmentally or socially sustainable);

- "Sustainable improvers" (for funds investing in assets to improve the environmental or social sustainability over time); and

- "Sustainable impact" (for funds investing in solutions to environmental or social problems to achieve positive, measurable real-world impact).

Pg. 30, CP.

Pg. 30, CP.Fund managers should be aware that where one of the above labels are used, the firm will remain responsible for the classification and ensuring that the chosen label is appropriate; the FCA makes it clear that any use of a label should in no way indicate FCA approval of the relevant fund.

- What does an in-scope firm need to do if it wishes to use one of the new labels?

The allocation of sufficient legal and compliance resource to implement and monitor the use of any label will be vital. The CP sets out a series of qualifying criteria which require firms to ensure that they are able to substantiate the claims they are making in relation to in-scope funds. Firms seeking to utilise the new labelling regime will need to review items including their fund documentation to ensure compliance with both the detailed cross-cutting and category-specific rules, as well as the new pre-contractual disclosure documentation required for institutional investors or retail clients, should the new rules and accompanying non-Handbook guidance be introduced in the UK during the course of 2024.

Fund managers should note that in terms of the proposed pre-contractual disclosure requirements, even if a proposed SDR label is not used, where sustainability-related features are integral to the investment policy and strategy (excluding firms providing portfolio management services), such funds may still be in-scope of the proposed rules.

- How is the FCA proposing to monitor the implementation of the proposed rules?

Broadly speaking, the FCA has stated it will:

- monitor the use of labels at a product level;

- carry out periodic assessments;

- take enforcement action where a firm has ignored disclosure requirements, made misleading disclosures, mis-used a label or breached the CP's naming and marketing rules; and

- carry out a post-implementation review three years after the regime comes into force.

- How do the FCA's proposals sit alongside other international sustainability labelling regimes?

The FCA has considered the CP regime's international coherence with both SEC proposals and SFDR, and has indicated how funds classified under those regimes may map onto the FCA proposals.

The SEC proposal creates three categories of ESG funds:- Integration funds: funds that integrate ESG factors with non-ESG factors would be required to disclose how ESG factors are used in the investment process;

- ESG focussed funds: funds where ESG factors play a significant role in or are the main focus of the investment strategy would be required to make a detailed disclosure of the investment strategy together with a standardised overview table; and

- Impact funds: funds that are ESG focussed and seek to achieve a specific ESG goal would be required to make additional disclosures as to how they measure their progress towards those goals.

The SEC proposed rules set out specific disclosure obligations in fund registration statements, fund annual reports and advisor brochures. Funds and their advisors will also be required to report on certain ESG matters in the new revised Form ADV and on Form N-CEN.

The SFDR also creates three categories of funds:

- Article 6: funds that do not integrate sustainability into the investment process;

- Article 8: funds that promote, among other characteristics, environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices ("light green" funds); and

- Article 9: funds that have sustainable investment as their objective ("dark green" funds).

For each fund registered or notified for marketing in the EU, the consequences of categorisation under Article 8 or 9 may require the production of information such as AIFMD Article 23 disclosures within the fund's PPM or separate wrapper, the addition of certain information to the manager's website and the fund's annual AIFMD report, as well as separate clarifying, technical or negative disclosures.

Fund managers should note that the FCA (i) does not consider that ESG integration to be "a sustainable investment strategy" in its own right; and (ii) has not incorporated the "Do No Significant Harm" or "Principal Adverse Impact (PAI) impact concepts located within the SFDR.

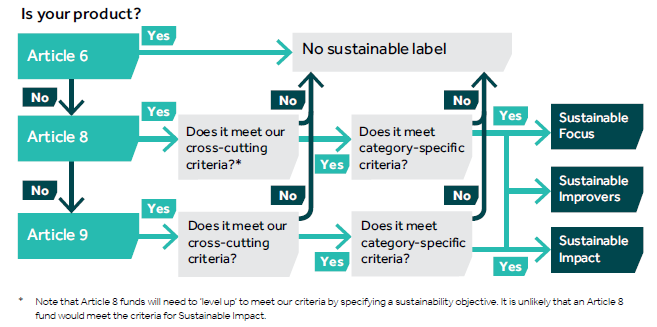

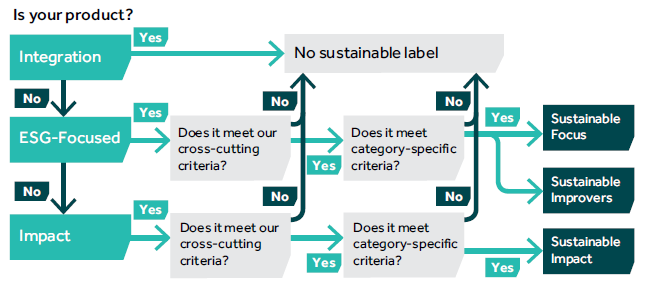

Whilst the FCA has sought to avoid inconsistences with the SEC and SFDR regimes, the three regimes do not map directly across. The FCA has, however, provided the following helpful flowcharts, which firms can refer to in order to assist them in mapping existing funds which are in-scope of SFDR (i.e., Article 6, 8 and 9 funds) and the SEC's three ESG fund categories (i.e., integration funds, ESG-focused funds and impact funds):SFDR

SEC proposals

Page 83, CP.

What's next?

The deadline for comments on the CP is 25 January 2023. The FCA will then aim to review feedback and set out the final rules in a Policy Statement by end of H2 2023, with a phased approached to the introduction of the proposals from middle of 2023 – 2026.

We will be working with clients and industry bodies through the proposals in more detail and provide further commentary in the coming weeks.

If you have any queries, please contact any of our private funds experts or your usual AG contact.

- Footnotes

[1] The UK Government’s ambition for Sustainability Disclosure Requirements and labels is set out in the Roadmap to Sustainable Investing published in October 2021 and the commitment made in the FCA's November 2021 ESG Strategy and 2022/23 Business Plan.

© The Financial Conduct Authority