The GB energy regulator Ofgem is consulting on a series of minded-to decisions for an interim regime for Multi-Purpose Interconnectors (MPIs).

The consultation forms part of a broader Offshore Transmission Network Review (see our summary) being carried out by Ofgem and the Department for Business Energy and Industrial Strategy (BEIS), where Ofgem is focusing on incremental changes to the existing framework to encourage MPIs in the near term and BEIS is exploring ways to create an enduring MPI regime for the longer term. See our related article on BEIS's response to the MPI regime consultation.

To facilitate near-term MPI projects, a number of changes to the current legal framework are being proposed.

- Asset classification

Under the current regime, assets are classified based on their primary function, and the activity undertaken on these assets is regulated by way of a licence - an interconnector licence to operate an interconnector, or a transmission licence for a transmission asset. The unbundling rules prohibit the same person from holding both an interconnector licence and a transmission licence.

MPIs are a nascent technology, combining characteristics of both interconnection and transmission, where the balance between those functions may vary and is subject to change. So which licence do they fall under?

Ofgem believes that the most reliable factor to determine primary use of an MPI is the offshore windfarm (OWF) load factor in combination with the interconnector cable capacity. A simple threshold is proposed to decide which licence to grant.

- MPI models

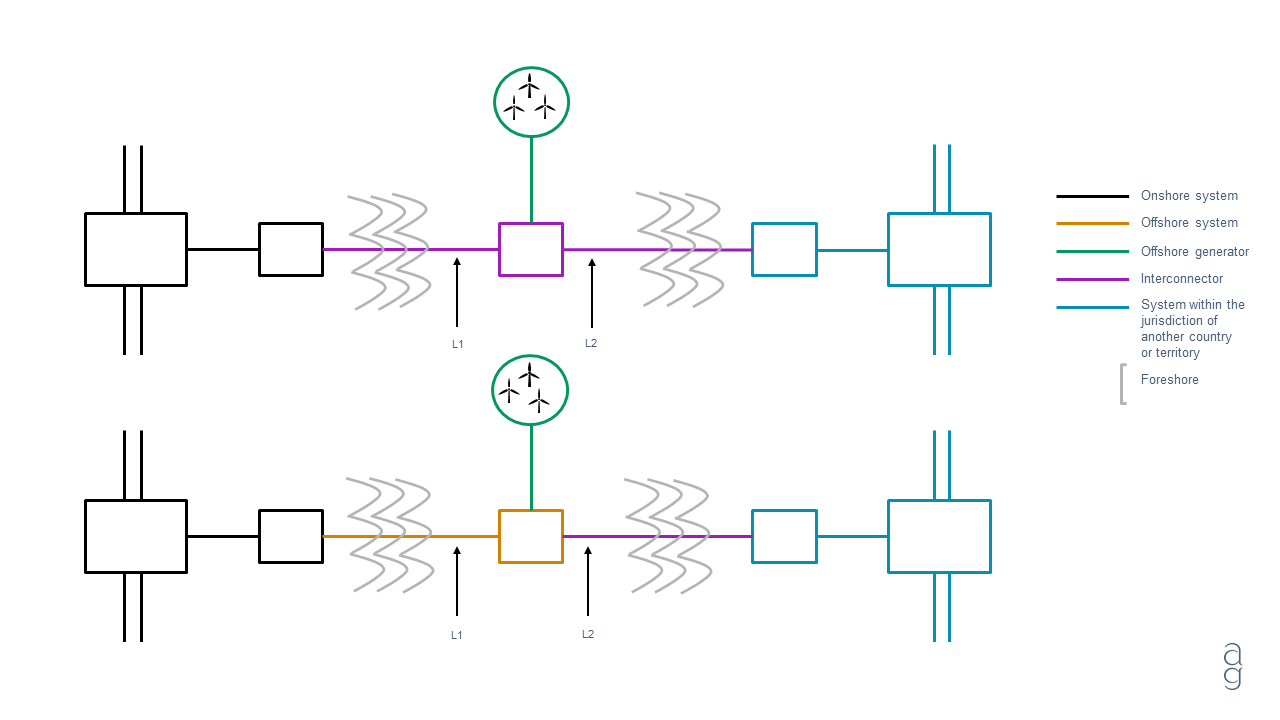

To help this analysis, Ofgem has considered two MPI models. In each case, the combination of assets does the same thing. The key difference is how they are classified and licensed. The two models are shown in the diagram below:

- the interconnector-led (IC-led) model (top), in which the interconnector (L1) is a single continuous asset with one licence, conveying electricity from an OWF:

- to the GB National Electricity Transmission System (NETS);

- to a connecting country for cross-border trade; and

- between the GB NETS and the connecting country (cross-border trade); and

- the OFTO-led model (bottom), where:

- the GB offshore system (L1) conveys electricity:

- from the OWF to the GB onshore system; and

- between the onshore GB NETS and a substation interfacing with the interconnector; and

- the interconnector (L2) conveys electricity:

- from the OWF to a connecting country for cross-border trade; and

- between the GB NETS (from the end of the OFTO) and the other jurisdiction (cross-border trade).

- the GB offshore system (L1) conveys electricity:

- the interconnector-led (IC-led) model (top), in which the interconnector (L1) is a single continuous asset with one licence, conveying electricity from an OWF:

- Determining primary use

The outcome depends on how the interconnector part of the asset is sized in comparison to the OWF load factor because this determines the capacity available for cross-border trade: if more than 50% is available, there is a strong argument for interconnection being the primary use.

Historic data shows that an average OWF load factor is around 42%, but this is expected to increase in the future with advances in technology. For the purpose of this analysis, Ofgem assumed a load factor of 45% and compared the interconnector cable capacity with the OWF installed capacity.

Where the cable capacity is the same or larger, interconnection is likely to be the primary use, but not where the cable capacity is lower than OWF installed capacity.

For the purposes of MPI licence applications, Ofgem is proposing to require the applicant to demonstrate the expected primary or main use of the asset, using a similar calculation, and showing how often the asset is expected to be available for cross-border flows compared with OWF output transmission over the lifetime of the asset.

- Reporting

To help verify the primary use of the MPIs, licensees will be required to provide annual declarations based on a self-assessment, with an in-depth review by Ofgem to follow after a five-year period.

- Risk of re-classification

The current regimes are not designed for mixed usage or a change in usage. The enduring regime may introduce this flexibility. During the interim period, if asset usage switches from the activity for which the licence is granted (for example, due to variations in wind conditions), Ofgem will deal with the situation on a case-by-case basis.

- Amendment to licence provisions

Ahead of any enduring regime, Ofgem is proposing a number of amendments to the existing interconnector and OFTO standard licence conditions to regulate MPI activity. This is intended to progress MPI projects in the short term, while building an evidence base to inform BEIS’s decisions for the enduring regime.

- Evolution of pre-existing assets to MPIs

In theory, MPI projects could evolve from assets which already exist, but the process would be technically complex and costly. Pre-existing assets are not expected to evolve into MPIs as part of the interim regime, although Ofgem would be open to considering such situations on a case-by-case basis. Its main focus, however, will be on MPIs that are designed as multi-purpose at the outset.

- Wider policy issues

The consultation sets out commentary on some wider issues which are outside of Ofgem’s decision-making, but which are considered important:

- ownership structures: under the interim regime, the current requirement for separate ownership of the OFTO, interconnector and generation assets will remain, but it is acknowledged that ownership of assets may be subject of a legislative change in the future;

- migration from interim to enduring framework: whether early opportunity MPIs would be able to migrate to a future enduring regime is a point for consideration for any enduring regime;

- pilot MPI cap and floor: as already confirmed in December 2021, eligible MPI projects will be able to apply for a cap and floor for the interconnector asset of an MPI in parallel to cap and floor Window 3 in mid-2022. Ofgem will consult in due course on project-specific licence conditions to accommodate MPI projects;

- transmission charging in the IC-led model: as a minimum, OWFs connecting to an interconnector will be expected to pay an appropriate and cost-reflective charge for the type of costs covered by Transmission Network Use of System charges (TNUoS) applicable on the GB NETS. Ofgem will consult in due course on how to ensure transparency and fairness of such charges and avoid any unforeseen impacts on wider users of the onshore network system. In the interim, it is considering whether the cap and floor reporting mechanism could provide comfort that the charges paid to the interconnector by the connected OWF for use of the asset are cost-reflective and not excessively high or low.

- Market arrangements

The cross-border nature of MPIs means that the domestic rules that govern them must be compatible with the rules of the connecting jurisdictions, including the EU.

A key concern is the relationship between the choice of market model - Home Market (HM) or Offshore Bidding Zone (OBZ) - and the requirement under Article 16(8) of Regulation (EU) 2019/943 (the Electricity Regulation) that at least 70% of interconnection capacity must be available for cross-border trade (the 70% requirement).

The HM, where the OWF forms part of its “home” bidding zone, is not compatible with the 70% requirement and would likely require derogations from the Article, but the OBZ, which contemplates a separate bidding zone containing one or more OWFs, does not present this dilemma since generation capacity sent to ether connecting market is considered cross-zonal. For this reason, OBZ is the European Commission’s preferred solution.

However, under the OBZ approach, OWFs would earn less revenue, which may discourage investment. This is because, under the HM, the OWF will receive the price of the “home” bidding zone, but under the OBZ the OWF receives the price of the exporting zone, which is lower.

Following the UK’s exit from the EU, the “70% requirement” has been removed from domestic law. The Trade and Cooperation Agreement (TCA), which now governs cross-border electricity trading between GB and the EU, requires the maximum level of capacity of interconnectors to be made available, respecting the need to ensure secure system operation and most efficient use of systems.

Ofgem will work with parties involved in the development of new cross-border trading arrangements pursuant to the TCA to identify the best way forward.

An important factor in the efficient use of MPIs is the use of implicit trading, where the capacity on the interconnector and the energy product are bought together, as opposed to explicit trading, where the capacity and the energy are traded separately.

Although technically, both HM and OBZ models could support both implicit and explicit trading, Ofgem’s view is that explicit trading is less efficient. It will continue engagement with the relevant bodies to support discussions in this space.

Another point of concern is the interactions between priority dispatch and curtailment in the different market models and the relationship between curtailment of interconnectors and the future cross-border trading arrangements under the TCA. In GB, new renewable generators cannot benefit from priority dispatch (Article 12 of the retained Electricity Regulation); and renewable generators may be curtailed only as a last resort (Article 13).

Ofgem will consider potential interactions between the two market models and whether there may be any possibility of a transition from one model to another. It will engage with industry to better understand the available solutions to further inform its thinking on the most appropriate arrangement for early opportunity projects.

The consultation closes on 9 June 2022.

Richard Goodfellow

Head of IPE and Head of Energy and Utilities (Global)

United Kingdom