Ofgem has published a consultation on its initial findings of the review of GB’s electricity transmission (ET) network planning processes (Electricity Transmission Network Planning Review or ETNPR), which it has been conducting since June.

The key proposal is to introduce a new Centralised Strategic Network Planning (CSNP) model to be delivered by an independent expert body, a central network planner, proposed to be the Future System Operator (FSO).

Proposals for a Future System Operator role were the subject of a separate consultation – see our article Future System Operator Consultation.

Why is the review necessary?

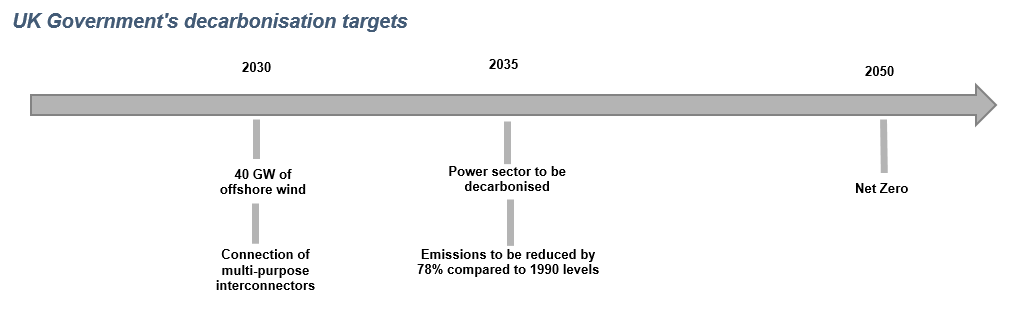

The review has been driven by the need to ensure that the ET network, which will play a key role in delivering decarbonisation, will be able to cope with the increase in renewable electricity generation and the changes in power consumption, expected to result from electrification of transport and heat.

To ensure that the network is fit for purpose for the future, the necessary upgrades must be planned well in advance, due to long lead times and the significant investment required for large ET projects.

This is challenging in view of the current uncertainties around the future technology mix, timing, location and size of the forthcoming generation and demand. Wrong decisions can result in stranded assets, system constraints and slower decarbonisation.

The current ET network planning process

Under the current arrangements, the Electricity System Operator (ESO) conducts annual Future Energy Scenario (FES) forecasts to identify where and how the current network capabilities may not be sufficient in the future. This information is provided to the transmission owners (TOs) who develop options to reinforce the network and send their proposals to the ESO.

Based on these proposals, the ESO conducts annual Network Options Assessments (NOA), carries out a cost benefit analysis to determine the optimum mix of investments across the FES scenarios and issues an indication of which projects should progress.

Ofgem believes that although the current process has helped coordinate plans for major investments in the ET networks, it has a number of shortcomings which could hamper decarbonisation:

- lack of an overarching strategic outlook that takes a GB-wide holistic view;

- the narrow scope of the current NOA, with its focus on load related investments and boundary capacity;

- insufficient level of coordination between different network planning processes;

- lack of a joined up view and approach to design and operability of the ET network across GB;

- the existing network planning process is largely reactive;

- investment options are led by the TOs who are not responsible for the entire network; and

- no involvement of third parties who could bring innovation and competition.

The narrow scope of the NOA has been highlighted before and in response, the ESO has launched three "NOA Pathfinder" projects, each designed to resolve specific system needs by widening participation in the NOA process to find innovative cost-effective solutions. The Pathfinders look at multiple (distribution, market-based and transmission-based) solutions for:

- high voltage system issues (the NOA High Voltage Pathfinder);

- stability issues in the electricity system (the NOA Stability Pathfinder); and

- reducing the cost of managing constraints at various places in the electricity system (the NOA Constraint Management Pathfinder).

Objectives for the future

Ofgem believes that the best way to overcome these challenges is by taking a strategic approach to planning of the electricity networks and the energy system as a whole, with a focus on:

- strategic investments: identification and progression of low regret “strategic investments” in the ET network that are key to delivering decarbonisation targets efficiently. Ofgem wants to move to a more centralised planning approach and to consider clustering large mutually dependent projects and/or projects which share a common set of drivers under a single regulatory approval and consent process;

- strategic planning: to optimise efficiencies in the design of the network with the location, timing, size and technology of expected new generation and demand, the ET networks and the energy system generally should be planned alongside each other. The planning process should enable solutions spanning the whole energy system: transmission and distribution, onshore and offshore, build and non-build, market, non-network options and, at a high level, solutions that could be electricity, gas, demand or generation. For example, hydrogen production plants, which will require large amounts of electricity, could be located close to renewable generation;

- onshore/offshore: holistic planning of onshore and offshore ET networks (and potentially, interconnection) together. This will build on the work being undertaken as part of the Offshore Transmission Network Review (OTNR) and the Interconnector Policy Review (ICPR). The recommendation for a CSNP model is aligned with OTNR’s proposals for a strategic plan and a single integrated approach for onshore and offshore, although Ofgem recognises that there may be a case for some different delivery models for onshore and offshore ET networks, considering that different assets and parties will be involved;

- an overall process for complete assessment of the ET network against all issues that might arise – for example, new connections should be designed with consideration of their impacts on the overall network rather than focusing on the cheapest local option. This will require an overhaul of the decision-making process to make it future-proof against uncertainty and will involve further consideration of the roles and responsibilities in ET network planning, the necessary skills, the regulatory incentives and obligations of the parties;

- innovation and competition: encouraging innovative and/or non-network solutions by third parties competing against each other; and

- early engagement of stakeholders in the design of ET networks.

As part of ICPR, Ofgem is reviewing the current developer-led approach to new Multi-Purpose Interconnectors (MPIs): the third cap and floor application window will be a developer-led process but the approach to the future MPI projects is under consideration.

OTNR is proposing a more coordinated approach to the siting of offshore wind and a move towards more centralised design of associated transmission, also incorporating MPIs.

Industry participants, developers and their sponsors are actively involved in the OTNR and, at a project level, are seeking to achieve coordination (for example, by reducing the number of individual connections through use of MPIs), cost savings and efficiencies. It remains to be seen whether ETNPR will add anything to what is already part of ICPR and OTNR.

Enduring regime and transitional arrangements

The consultation sets out proposals for both the enduring arrangements to deliver all of the above objectives and pragmatic transitional arrangements that can start realising some of the objectives from 2022 onwards.

Enduring regime

In the enduring regime, the CSNP model will cover all load-related ET network investment in GB, including onshore, offshore and potentially interconnection (subject to the outcome of the ICPR). It will be delivered in the following stages.

Modelling

Firstly, an optimised plan will be developed for necessary investment in the ET network to meet anticipated future needs through:

- modelling future energy demand and supply scenarios based on assumptions governed by strategic thinking;

- considering multiple possible scenarios where there is less certainty; and

- developing alternative ET network plans for the future covering each eventuality.

Assessment

The outputs from this modelling would be used to carry out an assessment of the overall needs of the system as a whole, identifying issues that will require mitigation through investments in the network and a broad range of possible options for each need, considering solutions that could resolve multiple needs.

Decision-making

The results of the assessment will inform the decision-making process, governed by strategic thinking, about which options should be taken forward.

Drawing on its expertise in energy system planning, the central network planner could give advice and recommendations to other stakeholders to help them make informed choices: the Government, to inform its wider energy system policies; the users of the system, to inform their decisions on new investment; and the planning consent bodies, to reduce consent times.

The coordinated designs and a more efficient utilisation of assets could reduce costs and the overall number of new assets required.

The CSNP will be reviewed periodically, likely every two to three years.

Transitional arrangements

The transitional arrangements, to be developed by the ESO, will include as a minimum:

- identification of low regret strategic investments on the onshore and offshore network that is key to deliver 40 GW of offshore wind generation by 2030;

- future energy demand and supply scenarios or estimates; and

- options for addressing system needs based on a cost benefit methodology which strikes a balance between cost and environmental and community impact.

During the transitional phase, clustering of large interrelated projects for regulatory submission and consents purposes will be considered where appropriate to do so. This could apply to projects being developed over the next 6-12 months; mostly, large projects worth £100 million or more, but potentially also smaller projects.

In the future there may be a coordinated planning consent process for clusters of ET projects, particularly where they share geographical proximity. However, for now, the clusters will be taken forward under the current regulatory framework.

Next steps

A decision on transitional CSNP arrangements is expected in early 2022, with the aim to implement such arrangements from 2022. At the same time, Ofgem will consider in more depth proposals for the enduring CSNP, possibly adding further topics as a result of feedback to the consultation.

The consultation closes on 17 December 2021.

Comment

This consultation throws up a number of questions in our minds:

- The criticism of the current NOA is fair, but could it be premature to start transitioning towards a centralised model before the Pathfinders are completed, their outcomes fully assessed, any lessons learnt and taken into consideration for the future?

- The benefits of a coordinated approach are attractive and necessary and some may be realised through OTNR (such as reduction of connection points): how much will CSNP add to what is already available elsewhere?

- Considering the different parties and different interests involved (developers, consumers, regulator, planning authorities), how will CSNP find the right balance between collaboration and competition? Since ET is a natural monopoly, competition in this area is already limited.

- The consultation rightly emphasises the importance of the necessary skills to deliver the objectives of CSNP. Will a central network planner be able to attract the right skills?

- In an effort to ensure that the decision-making process is strategic and full-proof against uncertainty, can it become too rigid or detached from reality?

- Could developers, acting in collaboration, find and deliver high level solutions spanning multiple sectors in a better way? One example of private partners taking advantage of sector synergies is a hydrogen project being developed in Rotterdam.

- How will a central network planner find a correct risk-reward balance to identify the right strategic investments? A private investor is risking its capital and is incentivised by competition: failure means financial loss; innovation is rewarded by profit. Will a central network planner have the right sensitivity to risk without the benefit of market signals and competition? The collapse into administration of Bulb Energy is the most recent reminder of the painful impact on the public purse of "too big to fail" – who will bear the cost of the central network planner's failures?

- Could CSNP create a too centralised approach and inadvertently stifle innovation by removing private initiative? History is abundant with examples of central planning systems which, instead of maximising efficiencies, developed into overstaffed inflexible bureaucracies. Will the regular reviews be sufficient to ensure that this will not happen to CSNP? What other mechanisms can prevent this?

We encourage you to respond to this consultation if you think you are likely to be affected by any of these issues. If you would like to discuss this further with us, please get in touch.