After a summer spent deliberating, Ofwat published its analysis of the costs and benefits of introducing competition to residential water customers in England on 19 September 2016.

For background, see our articles Competition in the household water sector and Ofwat's cost benefit analysis of household water competition.

The analysis concludes that on balance (and it is finely balanced) there would be a net benefit (or at least there would be in three of the four possible scenarios modelled) but that customers will need to have trust and confidence in the market and it will need a strong and effective regulator.

Cost-benefit assessment scenarios

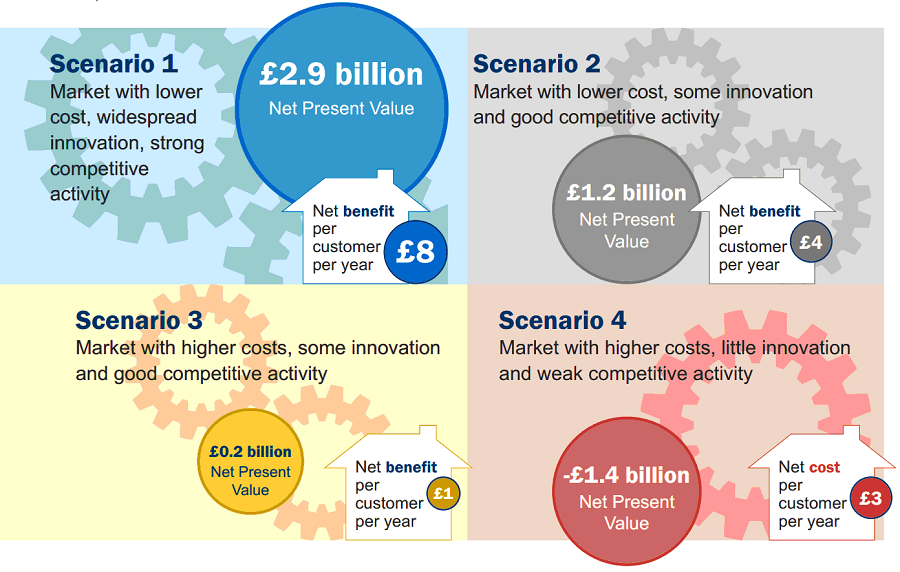

Ofwat used four possible scenarios modelled over a 30-year period, quantifying the costs and benefits where possible. Scenario 1 is a market with lower cost, widespread innovation and strong competitive activity. This produces a Net Present Value of £2.9 billion and a net benefit per customer of £8 per year (all figures are rounded up).

Scenario 2 is a market with lower cost, some innovation and good competitive activity, yielding a Net Present Value of £1.2 billion and a net benefit per customer of £4 per year.

Scenario 3 is as Scenario 2 but with higher costs. This impacts on the Net Present Value, lowering it to only £0.2 billion or a net benefit per customer of £1 per year.

Scenario 4 is a market with higher cost, little innovation and weak competitive activity. This gives a Net Present Value of -£1.4 billion (i.e. a cost) and a net cost of £3 per customer per year.

The diagram below summarises them:

Ofwat clearly prefer Scenario 1, which is what could happen if everything goes to plan: the business customer market is easily scalable to the residential retail market; non-water retailers (such as energy retailers) can add water to their offering at little extra cost, to offer a multi-utility package; there is strong competitive rivalry, especially from new entrants; retailers can reduce their wholesale costs; and customers are engaged. Even so, this only produces a net benefit of £8 per customer per year, although Ofwat anticipate that the real benefits will be in the quality of service that customers get, for example the use of water saving apps.

Scenario 4 is the worst case scenario: the residential retail market architecture is more complex than the business customer market, so entry costs are higher; there is limited competitive rivalry because the high costs put new entrants off; retailers therefore do not offer innovative products and services; and this, plus onerous switching costs, mean that only 15% of customers are actively switching after 20 years. In that case, the costs of setting up a competitive market will outweigh the benefits.

It is a fine balance though: if the costs of market opening end up higher than anticipated, there is the risk that the benefit will be minimal and that it could even end up costing customers more. The Government will need to decide whether the potential benefits are worth the risk.

Policy assumptions

Ofwat have in their analysis assumed that there are no changes to government policy. In particular:

- Metering – current metering policies continue; that metering residential premises is not mandatory and that customers can request a meter at their premises.

- Retail exits and separation – some form of retail market exit and separation is allowed for. The precise framework for such exit and separation would be subject to future policy decisions.

- Social tariffs – some form of protection would be in place for customers who struggled to pay their bills, although we have not taken any view on whether this protection would take the form of existing support schemes or some other form; and

- Disconnection – the existing prohibition in legislation on disconnecting residential customers remains in force.

There is clearly some scope here, if the government decides to proceed, for policy changes that will support competition. For example, offering water customers the equivalent of energy smart meters would enable retailers to offer more innovative products that saved customers money by reducing their water consumption.

What would an effective market look like?

Ofwat's summary document lists some changes that competition could bring, including:

- Multi-utility service bundles, so customers can buy energy, water and telecoms from the same retailer

- More use of technology (at the moment, only two water companies have an app to let customers manage their account)

- Challenge to wholesalers to keep their prices down, as national retailers will be in a position to compare local wholesale prices

- Retailers offering services to promote water and wastewater efficiency, and new services like leak detection

- Mergers and acquisitions of traditional water companies (such as the Severn Trent and United Utilities merger) and others exiting the retail market (like Thames, Southern and Portsmouth Water)

- More use of customer data, to help customers switch retailer.

Key requirements for competition to work

Ofwat suggest there are some key features about the design, opening and ongoing regulation of the market that are needed for competition to work. These include:

- Competition and competitors – obviously! There should be a choice for water companies to exit the household retail market and for it to be easy for new entrants to come in. Ofwat's scenarios assume this. We will have a better idea of appetite for competitors to enter once non-household competition has gone live. A key factor will be the margins available to potential retailers.

- Public health and safety – the actual water will still come from the same regional wholesale companies, but they will need to work closely with retailers to communicate with customers if there are any problems.

- Resilience and long-term planning – retailers will have incentives to provide water efficiency services to reduce consumption and bills, and this in turn could bring wholesale costs down by avoiding the need for costly new investment, but both wholesalers and retailers will need the right incentives to work together over the long term.

- Customer engagement – it needs to be as simple and easy as possible for customers to choose a water retailer. Good quality, standardised customer data is key to this. Market design and regulation can ensure this data is available. This has been an issue in the energy market, where the margins for retailers are much larger.

- Vulnerable customers – will need protecting. Some form of tariff regulation might be necessary, but the difference between the best and worst deal in a competitive water market will be less than in the energy market, as 90% of a customer's water bill is the cost of wholesale services that Ofwat regulate the price of.

Timings

Ofwat stress the difference between the decision on whether to open the market to retail competition, and when to open it.

Ofwat think the Government should make the decision on whether to open the market as soon as possible, before it starts the 2019 price review process in July 2017, so that retail market opening can be taken into account during the process if necessary. It would also help companies decide whether they wanted to take part in the business customer market or not.

As to when to open it, there could be a phased opening or an all-out full opening, and there are pros and cons to each. A competitive residential retail market in England would be the largest competitive water retail market in the world and would affect every residential customer in the country. So, time would be needed for planning and delivery to be thoroughly tested at key points. The Government should also consider how the date of residential market opening could be best-timed to enable those involved in the business customer market to take advantage of the experience and skills, and capture the lessons from that process.

What next?

It is now up to the Government to decide how to proceed. Watch this space!

Rona Bar-Isaac

Partner, Head of Competition, Co-Head of Retail & Consumer Sector

London, UK