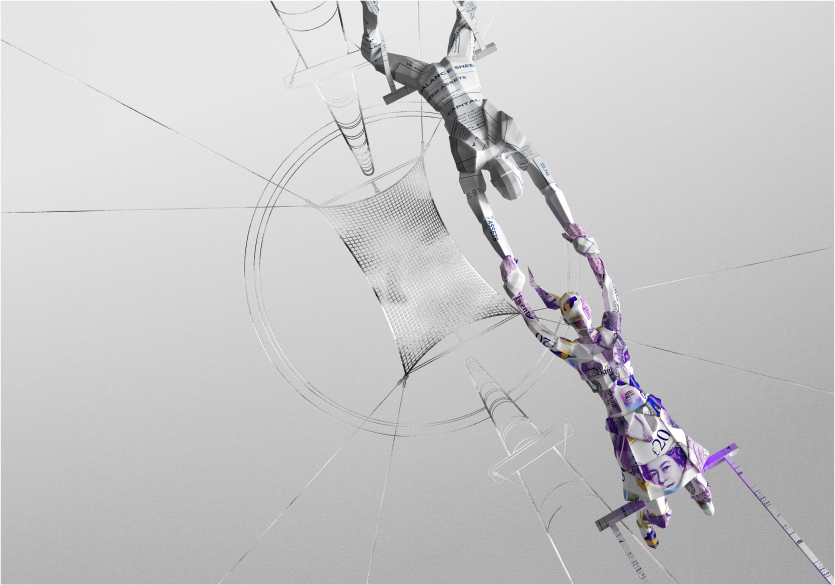

PROTECT YOUR INTERESTS. FREE YOUR BALANCE SHEET.

– Who is Control for? >

– Why choose Control? >

– How does it work? >

Introducing Control

– Is litigation finance the best strategy for you or your business?

– Are you picking the right battles?

– Have you negotiated the best funding arrangements?

– Which of the many risk-share options should you choose?

– And how will the other party behave if they have their own funding?

When it comes to litigation finance, we’re all seeking certainty. Whether you’re looking to access a war chest to fight your corner, investing to bring a case, wanting to know you’re backing a winning cause, or looking to provide innovative financing options for your own clients, you’ll want clarity, confidence and more control over the outcomes.

For over a decade, litigation finance is a field we’ve made our own, equipping companies with the funds to protect their interests and free their balance sheets. To date, we’ve worked on over 200 cases using litigation finance, supporting clients in Europe, Asia, North America and Africa. And, in contrast to many, we bring a full-market view, working with multiple funders, as well as advising other law firms on single case and portfolio funding arrangements. We call our service CONTROL.

Who is Control for?

Litigation finance is proven to help companies protect their interests, without diverting funds from other investments. But to ensure it works effectively, it needs to be structured with care and genuine expertise.

- If you’re in a dispute

We’ll help you pursue or defend a claim, whether that’s through arranging the funding, fighting your corner on the dispute itself or both. In many cases we’ll take on a share of the risk, so we've invested in your cause.

- If you want impartial advice on your litigation finance

We’ll provide clear advice on your options, review funding arrangements being put to you, or simply offer guidance around where to start and the pitfalls to avoid.

- If you’re a litigation funder

We can advise you on the claim you may be seeking to fund, your template agreements, or help develop the best way to structure a bespoke funding arrangement.

- If you’re a law firm

We’ll help you navigate the many different financing arrangements available, and can help you to develop the right options to benefit your business and your clients.

Why work with us?

Our specialist team advises companies, funders and other law firms – in the UK and globally – on how to structure litigation financing arrangements. It’s a core discipline for us which means we’re able to provide fully joined-up expertise, giving you the most complete view of your options and opportunities.

This means you get:

- The right arrangement – not the only one on the table

We work with multiple funders – including the most active in the market – so we understand the full breadth of approaches and terms available. And because we work with companies, funders and law firms, we understand the risks and concerns for everybody involved. We know what all the parties are thinking, how they will approach the case and, as a result, provide more holistic, informed and complete advice.

- Broader, deeper and sharper thinking

With legal expertise that spans disputes, finance, funds, commercial, insurance, reputation management, professional practices and corporate law, we don’t look at litigation finance in a vacuum. That’s because every decision you make has a knock-on effect, often encompassing multiple practice areas. So, to give the most informed advice, we draw on expertise from across our firm – whatever the sector or specialism.

- A risk-sharing, hard-hitting partner

Having a fully joined-up, cross-practice approach means we’re not only better placed to help companies, funders and law firms pick the best cases and funding options – we’re then able to successfully fight them. We were named Dispute Resolution Firm of the Year in 2019, and have advised FTSE 100 companies on 480+ disputes in the last two years. We’re confident in our approach and regularly enter into risk-share arrangements. We practise what we preach on disputes and have ‘skin in the game’ in a very real sense.

Take Control

"AG combined both the litigation and corporate expertise, which enabled us to have a unique lens on the issues"

Global corporate client

Addleshaw Goddard Control, at a glance

Fast facts:

We’ve worked with nine of the UK’s biggest funders.

Cases using litigation finance fought to date in Europe, Asia, North America and Africa.

We were ranked as the top Dispute Resolution Law Firm of the Year in 2019.

We’ve acted on nearly 500 disputes for FTSE 100 companies in the last two years.

Ranked Professional Practices Group - recognised as the UK's leading practice advising national and international law firms.

How does it work? What litigation finance options are available?

Control is a fully joined-up, full-market, cross-practice approach to litigation finance. We help companies, funders and law firms pick the best cases and funding options – and then successfully fight them. We can help you with just one element, or several.

Control service options:

- Advisory and structuring

We help all parties – companies, funders and law firms – to identify and implement the right financing solutions for them. This includes advising on single-case, portfolio and bespoke financing options, funding agreements and contingency fee arrangements.

- Case assessment

We advise companies and funders on which disputes to fight from a commercial and legal perspective. Put simply, we help them back the winners.

- Litigation

Fight or settle? Act or wait? When it comes to litigation, we help clients to execute the best course of action so they can protect their interests and achieve the best possible outcome.

- Insight

As one of the pioneers in litigation finance, we're often the first port of call for companies, funders and law firms who want to understand the marketplace. We bring clarity to the complexity – drawing together knowledge of litigation, finance and funding markets, commercial terms, professional practices and regulatory requirements.

The blend of litigation finance options available:

Please get in touch if you would like to discuss any of these options in more detail, or for professional advice on which might be appropriate for your particular circumstances.

- 1. Damages Based Agreements (DBA)

A DBA is an agreement under which we make no charge for our services during a case. Instead, if the claim succeeds we are paid an agreed percentage of the damages recovered by you.

- Who is responsible for other costs and disbursements? We are responsible for the fees of any barristers that are instructed. You may have to pay other expenses, such as court fees and expert witnesses, but options exist to mitigate or otherwise fund those costs.

- How are we able to offer this at no cost to you? Having entered into a DBA with you, we set-off some of our risk using funding or insurance at our own expense.

- 2. Conditional Fee Agreements (CFA)

Under our 'no win, low fee' model, we offer a discounted rate during the life of the dispute. If ‘success’ (as defined and agreed at the outset) is not achieved, that is all you would pay. If success is achieved, at the end of the case you would pay the difference between the full rate and the discounted rate (the 'deferred fees') and a success fee. The deferred fees form part of the 'base costs' (i.e. costs at our full rate) and are therefore recoverable from a losing opponent in the ordinary way. The success fee, which is not recoverable from a losing opponent (subject to limited exceptions), will not be more than the deferred fees, and will often be less.

- 3. Third Party Funding (TPF)

A commercial provider would pay your legal fees and costs of the litigation or arbitration, as a claimant, in return for a share of the damages in the event of success. TPF provides an option for effectively removing litigation costs from your balance sheet, as well as sharing risk with a third party who has independently assessed your claim.

- 4. After The Event (ATE) Insurance

ATE insurance is frequently used together with other financing options. Traditional ATE insurance provides cover against adverse costs orders, (i.e. a party’s liability to pay the other side’s legal costs in the event of losing an application or a claim as a whole). The ATE insurance market has matured and diversified and coverage for disbursements, such as experts’ fees and barrister's fees, or for a proportion of your own solicitors’ fees is now widely available.

Premiums can often be contingent on success and deferred until the end of the case, meaning you will not have to pay in the event you lose and have to make a claim under the policy. You will have to pay the premium only if you win, but in those circumstances you should be in receipt of damages.

ATE insurance provides certainty as to potential exposure by crystallising the amount of the contingency and effectively taking it off the balance sheet.

Video Hub

- Litigation Finance Perspectives Series

The Litigation Finance Perspectives Series covers a wide spectrum of market themes and predictions.In this series, some of the leading stakeholders within the litigation finance market share their thoughts on how the market is changing and responding to business needs. Explore how litigation finance can be used by businesses in today's market and get a first-hand insight how the market is likely to evolve.

Watch the series:

1) The class action perspective

What does the future hold for class action litigation funding? Watch on as Stephen O'Dowd from Harbour Litigation Funding shares his views on the risk management option transforming the global disputes market.

2) The predicting litigation outcomes perspectiveWhat are the fundamentals in predicting litigation outcomes? Watch Managing Partner, Robert Rothkopf, as he shares the three techniques used at Balance Legal Capital to help improve litigation forecasting accuracy.

3) The different model perspective

How can litigation finance clients benefit from using different funding provisions? Ayse Lowe, Vice President at Bench Walk Advisors LLC talks about the emergence of a different funding model on the international stage – portfolio funding. Watch the video to find out how portfolio funding differs from single case funding.

4) The international perspective

What are the latest changes in litigation finance law across the world? Which jurisdictions have embraced the most recent changes? Charlie Morris, Chief Investment Officer, EMEA & APAC at Woodsford Litigation Funding, paints the international landscape of the litigation finance industry in the video below.

5) The personal perspective

What skills and knowledge can businesses that use litigation finance benefit from while in a long-term relationship with professional funders? Hear the personal perspective of Paul Martenstyn, Managing Director at Vannin Capital: why he joined a funder, how funders are changing, and his predictions for the market.

6) The market perspective

What does the litigation finance world look like from a funder's perspective? Nick Moore, Litigation Officer with Therium, shares a funder's insight into the local London market and what the future holds.

Key Contacts

Sivan Daniels

Partner, Finance Disputes & Commercial Litigation

+44 (0)20 7160 3284

Email Sivan >

View profile >

Felix Dörfelt

Partner, Commercial Disputes and International Arbitration

+49 (0)40 87 4060 29

Email Felix >

View profile >

Edward Gratwick

Legal Director and Solicitor Advocate, Dispute Resolution

+44 (0)131 222 9466