After many twists and turns and lengthy delays, the Cabinet has agreed to draft legislation to pave the way for a new pensions auto-enrolment scheme which will see potentially hundreds of thousands private sector workers automatically enrolled into a pension scheme.

Background

On 29 March 2022, Social Protection Minister Heather Humphreys received Cabinet approval to begin the process of drafting legislation which will underpin the long-awaited pension system that will see as many as 750,000 private sector workers automatically enrolled into a pension scheme.

Over the years a number of attempts have been made to introduce some form of pension auto-enrolment system in Ireland but none have reached the stage of drafting legislation. Minister Humphreys noted that the scheme was a “long time coming” and that some form of a programme to supplement the state pension had been discussed for nearly two decades.

Auto-enrolment is aimed at solving the problem of people who do not enrol in a pension scheme because they ‘haven’t got around to it’. Minister Humphreys stated that auto-enrolment would change a system whereby workers were “often left to their own devices to navigate what is a complex world of pensions to one in which choices and options are simplified on their behalf.”

Features of the Scheme

The following elements of the new pension auto-enrolment pension scheme have been settled in principle by Government:

Eligibility / Ability to opt-out

All private sector workers aged between 23 and 60 years of age, who earn more than €20,000 per year will be automatically enrolled into the new scheme unless they are existing member of a pension scheme.

Those outside the eligibility criteria (for example, those earning below €20,000 or those aged under 23 or over 60 years of age) will be able to ‘opt-in’ to the scheme if they so wish.

Membership of the new scheme will be compulsory for the first six months. Thereafter, members can choose to ‘opt-out’. Members who choose to opt-out will receive a refund of their own contributions paid up to the point of opt-out. Members will be automatically re-enrolled after two years but will have the ability to opt-out again under the same circumstances as outlined above. The option to opt-out will only exist in the first ten years of membership and thereafter members will be able to suspend payment of contributions but they will not be entitled to a refund of their contributions – instead the contributions will remain in the pot.

Contribution Levels

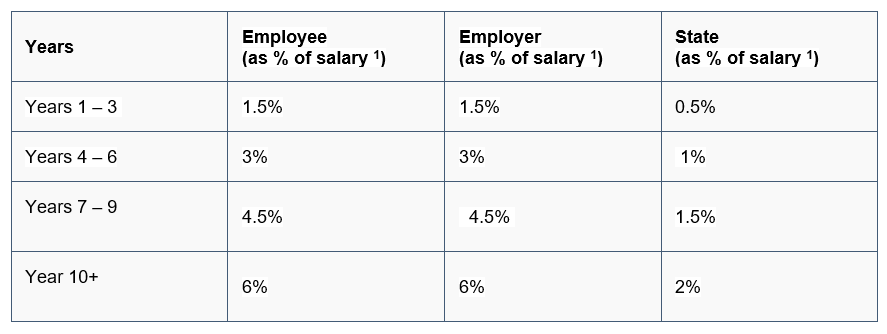

The new scheme will see contributions paid by employees being matched by their employers and the State will also add a top-up to the money paid into the scheme.

Contributions to the scheme will be introduced on the following a phased basis:

The scheme will be capped at €80,000 of an employee’s gross salary but people earning above that amount can still make additional contributions to the scheme. However, employers will not be required to match the amount.

Accessing funds

It is proposed that there will be a limited ability for members to access their accumulated retirement savings with only serious illness being considered as grounds to do so.

Administration and Investment

A Central Processing Authority (CPA) will be established to administer the scheme. The pension contributions will be invested by four registered providers, and there will also be four different investment portfolios available for members, depending on their risk appetite. It is envisaged that there will be an online portal where members will be able to review the size of their pension pot.

Commencement

It is proposed that new scheme will come into effect from 2024. Minister Humphreys expects that the heads of bill to be drafted and approved by the Government before the end of this year, with the legislation to be enacted by the third quarter of 2023.

Penalties for Employers failing to implement

Employers who fail to implement auto-enrolment scheme for its employees or fail to deduct and remit contributions will face administrative penalties initially, and ultimately risk prosecution as a criminal offence.

Is auto-enrolment the solution to Ireland’s pensions time bomb?

It is estimated that just 35% of private sector workers have an occupational pension scheme. With so few private sector workers making any provision for their retirement, the fiscal implications of the hundreds of thousands of retired private sector workers relying on the state pension as the main source of their income is deeply worrying. The introduction of this auto-enrolment system is aimed at reducing strain on the already unsustainable state pension system.

However, there some issues and criticisms in respect of the proposed new scheme. Chief among these is the effect the new scheme is likely to have on employers. With a backdrop of businesses recovering from the pandemic and the ongoing energy crisis, employers will understandably be concerned about the costs of this new scheme. A connected fear is that, in order to control costs, employers who currently offer more generous pension schemes may be tempted to treat the auto-enrolment scheme as a cost saving opportunity and phase out their existing schemes.

However, the proposed scheme is a significant step towards dealing with Ireland’s ticking pensions time bomb and increasing pension coverage for private sector workers. Auto-enrolment may go a long way towards securing the financial futures of hundreds of thousands of private sector workers who at present have made no provision for their retirement.

[1] Up to a maximum gross salary of €80,000.