Ensuring that firms treat customers fairly is at the heart of the FCA's consumer protection agenda. Understandably therefore, complaint handling has long been a focus for the FCA.

A history of regulation

The FCA have repetitively commented on firm's inabilities to embed a culture that is committed to the fair treatment of customers, noting that a firms overall attitude towards complaint handling is a strong indicator of this. Increasingly the FCA does not define success as simply reaching a regulatory implementation milestone, but rather, being able to evidence defined improvements for consumers.

Rather than seeing complaint handling as burdensome, it offers a valuable opportunity for firms to rebuild and enhance relationships with their customers when something has gone wrong, and provides an opportunity to use information gathered during the complaint handling process to make changes that deliver fair outcomes for their wider customer portfolio.

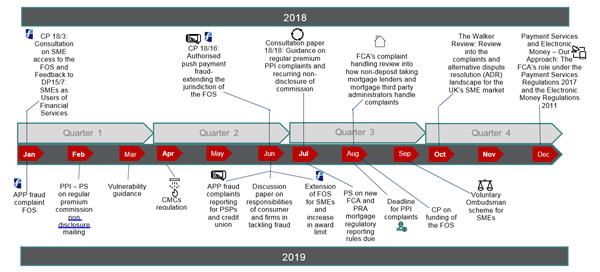

The FCA has conducted a vast amount of research into complaint handling in financial services over the years, with an enhanced focus in 2018 and an array of papers expected in 2019.

View the PDF version of this article to see a detailed timeline of this research and papers

Historic findings and learning from past mistakes

Recurring themes found in FCA research:

- Culture: weaknesses found in culture, particularly governance arrangements, policies and controls. Through establishing the right culture, senior management can convert good intentions into fair outcomes and firms need to be able to demonstrate that senior management have instilled a culture that promotes the fair treatment of consumers;

- DISP: firms finding it challenging to interpret DISP and other FCA non-handbook guidance, when deciding on fair customer outcomes. DISP does not provide "black and white" guidance, so firms rely on self-judgement and FOS intervention. However, as FOS assess complaints on a case by case basis, a blanket industry approach to complaint handling is not always possible;

- Flexibility: firms applying a "tick-box" approach to complaints handling, which allows limited flexibility when making decisions on how to resolve a complaint;

- Policies and processes: inflexible complaint handling as a result of an over-reliance on policies and procedures limiting staffs ability to exercise judgement. Most notably an increased risk of harm to consumers through inadequately implemented complaint handling policies and processes which result in enforcement action;

- Communicating with a customer: failure to provide a clear explanation to the customer about the outcome of the complaint and why this outcome had been reached;

- Management Information (MI): insufficient MI resulting in firms failing to properly identify complaints once they are received, linked to failings in Root Cause Analysis (RCA), highlighting concerns that some firms are unable to differentiate between a "situation" and a "symptom";

- RCA: The quality of RCA impacts firms abilities to identify recurrent or systemic problems and take appropriate action. Firms that undertook effective root cause analysis benefited from being able to proactively identify issues and act before they became more widespread; and

- Financial Ombudsman Service (FOS): failure to provide customers the required information about the FOS i.e. right to refer to FOS if they remain dissatisfied.

Things you should be thinking about

Based on the FCAs recurring themes and our experience of working with clients, we suggest that you should be thinking about:

- creating a plan of action for proactive complaint handling;

- reviewing current procedures on how to identify a complaint and whether these are in line with FCA expectations;

- reviewing current communications with customers to ensure they are fair, clear and not misleading;

- reviewing current process and procedures in place relating to how you currently record and deal with customer complaints;

- assessing complaints fairly, consistently and promptly;

- reviewing internal systems and controls to ensure they allow staff to identify and record complaints correctly;

- establishing and maintain effective and transparent procedures for the reasonable and prompt handling of complaints;

- conducting assurance reviews of your current complaint handling policies and procedures and your staff knowledge and understanding of these;

- ensuring that the MI that is collected is accurate and relevant to your operations and that actions are being taken off the back of this;

- ensuring that you have robust RCA capabilities to identify and remedy any recurring systemic problems;

- ensuring that you have appropriate governance and processes in place to make sure RCA is used correctly to accurately identify recurring or systemic problems; and

- ensuring that processes are in place to oversee that your FCA annual or biannual complaints return is accurate.

How can Addleshaw Goddard help?

We understand the challenges that in-house compliance teams can face juggling the ever changing, complex regulatory environment. We have an experienced team specialising in complaint handling who have experience of working:

- at one of the 'big 4' consultancy firms, undertaking complaint handling assurance reviews, drafting complaint handling policies and supporting firms with large scale complaint handling remediation projects;

- in-house in senior management complaint handling roles;

- at the Financial Conduct Authority, with complaint handling regulatory oversight; and

- at the Financial Ombudsman Service adjudicating consumer complaints.

We can provide as much or as little support as you require and we have the flexibility and resource within our team to support projects of all sizes, from providing secondees for on-site oversight and advice to dedicated remote compliance support.

If you would like to know more or would like to discuss anything further, please get in touch.

You can download a PDF version of this article here