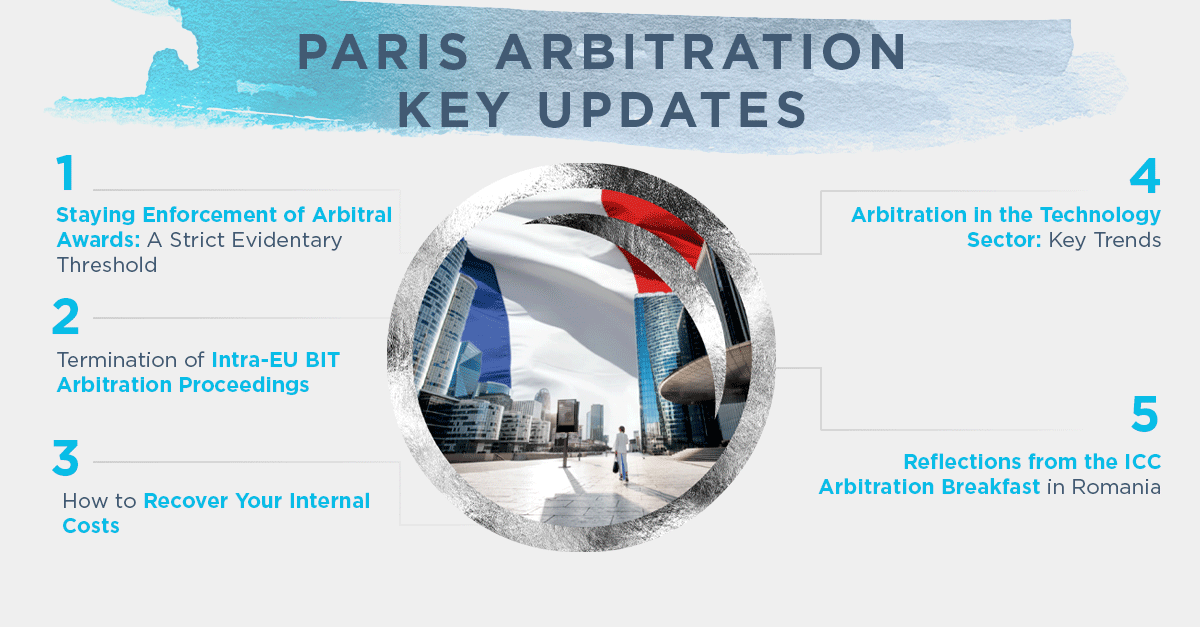

Welcome to our latest update, focused on bringing you closer to the pulse of arbitration in Paris. In this edition we have curated key arbitration points that we believe are important for you, our clients

Enjoy the read! Please do get in touch if you have any feedback or questions.

Ioana

LATEST FRENCH ARBITRATION CASE LAW

ARBITRATION & STAY OF ENFORCEMENT: In a decision dated 6 May 2025, the Paris Court of Appeal addressed the question of whether the enforcement of an arbitral award can be stopped if it is likely to gravely harm the rights of one of the parties.

The Court emphasised that under Article 1526 CPC, enforcement can only be stopped if there is clear evidence of grave harm to the applicant’s rights, which must be appreciated strictly “so that this risk must, at the time the judge rules, be sufficiently substantiated”. The Court held that Amor Jordan failed to provide such sufficient evidence of grave harm, citing a lack of detailed financial documentation and the speculative nature of its financial expert report. It further ruled that a temporary cash flow issue did not meet the strict threshold for grave harm and could be resolved through restructuring or credit.

Takeaway? This decision highlights France’s pro-enforcement stance, reaffirming that parties must provide robust and concrete evidence of grave harm to justify a stay of enforcement, in order to ensure the finality and effectiveness of arbitral awards.

(Read my analysis of the Paris Court of Appeal’s decision here)

REGIONAL HIGHLIGHTS – Dutch Court Orders the Termination of an Intra-EU BIT Arbitration

On 22 April 2025, in a landmark decision with significant implications for intra-EU investment arbitration, the Amsterdam Court of Appeal has ordered a Dutch company, LC Corp, to withdraw its arbitration claim against the Republic of Poland under the now-terminated Netherlands-Poland BIT, adding also a penalty of EUR 100,000 per day of non-compliance.

Here are the key aspects of this important decision:

- LC Corp, a Dutch investment company, initiated arbitration proceedings against Poland under the Netherlands-Poland BIT, alleging expropriation and unfair treatment of its investments as a result of restructuring measures taken by Polish financial supervisory authorities in respect of Polish companies of which LC Corp was the shareholder,

- Poland, in contrast, argued that no valid arbitration had been concluded and that the arbitration thus violated EU law, and sought that LC Corp be ordered to cooperate in submitting a joint application to the arbitral tribunal for discontinuing the arbitration proceedings,

- The Amsterdam Court of Appeal ruled that the arbitration clause and the sunset clause in the Netherlands-Poland BIT had lapsed as they were incompatible with EU law, rendering the arbitration agreement invalid,

- LC Corp was found to have acted unlawfully by “deliberately [seeking] to circumvent that applicable system of legal protection” to intra-EU disputes by pursuing arbitration outside the EU (in London). The Court emphasised that disputes concerning intra-EU investments must be resolved within the EU legal framework, replacing arbitration with national courts and EU law protections,

- The Court thus found that “LC Corp must cooperate in stopping the arbitration proceedings”, explaining that “[Poland]’s interest in the immediate enforcement of the injunction to be imposed on LC Corp outweighs LC Corp’s interest in continuing the arbitration”,

- In addition, the Court imposed a penalty of EUR 100,000 per day of non-compliance (up to EUR 10 million) to ensure LC Corp’s cooperation in discontinuing the arbitration proceedings within two weeks of service of the judgment,

- The Court also noted that enforcement of any award against Poland outside the EU could expose Poland to infringement proceedings by the European Commission for unlawful state aid.

PRACTICAL TIPS – Recoverability of Internal Costs

The involvement of companies’ internal teams in arbitration proceedings is becoming increasingly significant. Many organisations are now leveraging not only their internal legal teams to manage their disputes effectively but also engaging their operational teams to provide technical support throughout the process. However, the question of whether these costs are recoverable remains a nuanced issue that parties should carefully consider. Based on recent arbitral practices and relevant rules, here are key practical insights for managing and potentially recovering your internal costs:

- Understand the tribunal’s discretion: Most arbitration rules, including ICC, LCIA, and UNCITRAL, are silent on the specific recoverability of in-house counsel and operational costs. However, their broad wording allowing for the recovery of “legal and other costs” usually gives arbitral tribunals discretion to award these costs if they are proven reasonable and directly related to the arbitration,

- Keep detailed records: Internal costs are often poorly substantiated. To maximise your chances of recovering them, you should maintain detailed time records (similar to those kept by external counsel) that include the nature of tasks performed, the time spent, and how these efforts were directly linked to the arbitration,

- Avoid duplication with external counsel: Tribunals often scrutinise whether in-house counsel costs overlap with the work of external lawyers. To mitigate this, you should clearly delineate the roles of in-house and external counsel, and ensure that any in-house work is complementary and not duplicative,

- Determine reasonable hourly rates: Tribunals require evidence to assess whether internal costs are reasonable. This is why you should seek to benchmark hourly rates against external counsel with similar experience or calculate them based on your employees’ annual salary and overheads,

- Highlight cost efficiency: Tribunals are more likely to award internal costs if you can demonstrate that their involvement reduced your overall legal expenses. You should therefore emphasise how using your in-house and operational resources avoided higher costs that you would have incurred by relying solely on external counsel,

- Anticipate regional and jurisdictional differences: While internal costs (in particular in-house counsel’s) are recoverable in principle under English law and often awarded in jurisdictions like Switzerland or France, some tribunals may take a more restrictive approach, especially in regions where such claims are less common. Tailor your strategy accordingly,

- For Claimants: As claimant, you should be prepared to justify internal costs in detail during your submission on costs. If your in-house or operational teams played a significant role, make this clear early in the proceedings and consider addressing the issue in procedural orders or the Terms of Reference,

- For Respondents: Weigh the risks and carefully evaluate your position before opposing claims for internal costs, especially when these costs are well-documented and reasonable. A blanket objection may not be persuasive and could lead to adverse cost consequences,

- Anticipate and plan proactively: From the outset of a dispute, you should implement internal systems to track in-house and operational time spent on arbitration-related tasks. This will not only strengthen your cost recovery claim but also provide clarity on resource allocation and save you a lot of time!

SECTORIAL NEWS – Arbitration in the Technology Sector

With the rapid evolution of technology and its integration into every aspect of our modern life, the tech sector has become a particularly fertile ground for cross-border disputes. The extremely dynamic nature of technological advancements, coupled with the global reach of tech companies, has created unique challenges and opportunities for the arbitration landscape. From investor-state disputes involving regulatory changes to commercial disputes over digital assets and emerging technologies like the metaverse, arbitration has indeed proven to be a flexible and effective mechanism for resolving tech-related conflicts

- Definition: The UNCITRAL Working Group II has attempted to define tech disputes broadly, to encompass any dispute involving a technology component (e.g., disputes arising from the use of specific technologies, or involving tech companies). While this definition provides flexibility, its exact scope and purpose remain open to interpretation,

- Investor-state arbitrations: Disputes often arise from state actions that impact foreign tech investments, such as bans or regulatory changes. Notable examples include PCCW Cascade's arbitration against Saudi Arabia following the forced liquidation of a telecom consortium, Devas Mauritius Ltd’s successful claim against India for unlawful expropriation of its satellite services investment, and Huawei’s ICSID case against Sweden over its exclusion from the 5G rollout,

- Disputes involving digital assets: Digital assets such as non-fungible tokens (NFTs) and metaverse-related intellectual property have been at the centre of recent cases, highlighting the increasing complexity of disputes in this area. Examples include the Binance arbitration before the HKIAC, the MetaBirkin case involving Hermès and NFTs, and the Golfzon case in South Korea concerning metaverse-related copyright infringement,

- Arbitrating crypto disputes: Many crypto-related disputes are governed by arbitration clauses included in online user agreements, and often involve trading losses due to platform outages, payment failures, or misrepresentation of investment risks. Enforcement of crypto-related arbitral awards also remains challenging, with some awards being denied on public policy grounds,

- Commercial tech collaborations: Collaborations between tech companies and other industries, such as automotive or healthcare, often give rise to disputes over contributions, their valuation, and compensation. Further issues can arise from adaptations to changing technologies or regulations, market demand, competitor activity, or force majeure events,

- Arbitration's increased expertise: The arbitration community has actively sought to adapt to the tech sector's complexities. Institutions like the Silicon Valley Arbitration & Mediation Center (SVAMC) have developed resources such as lists of arbitrators with technical expertise (the “Tech List”), ensuring that disputes are resolved by professionals familiar with the specificities of the tech industry.

BY THE WAY

Last week, I had the chance of organising the first edition of the ICC Arbitration Breakfast in Romania. As a Romanian and a member of the ICC Court of Arbitration, it was a real pleasure to be back in my hometown Bucharest for this important initiative!

I co-hosted this event in my role as ICC Court Member for Romania, together with my colleague Sebastian Gutiu, the alternate member of the Court for Romania. We had the pleasure of welcoming also the Secretary General of the ICC Court, Alexander Fessas. Together we shared some exciting insights into ICC arbitration with our audience, including a behind-the-scene look at the ICC Court’s scrutiny process for arbitral awards, and key financial aspects such as costs, from the administrative costs to the legal costs and also, the costs of the internal teams of the parties.

This event was not only about the very interesting discussions we had, it was also about gathering the arbitration community and creating an occasion to exchange views and discuss issues specific to Romania. We will continue these efforts and are already planning more events and initiatives.