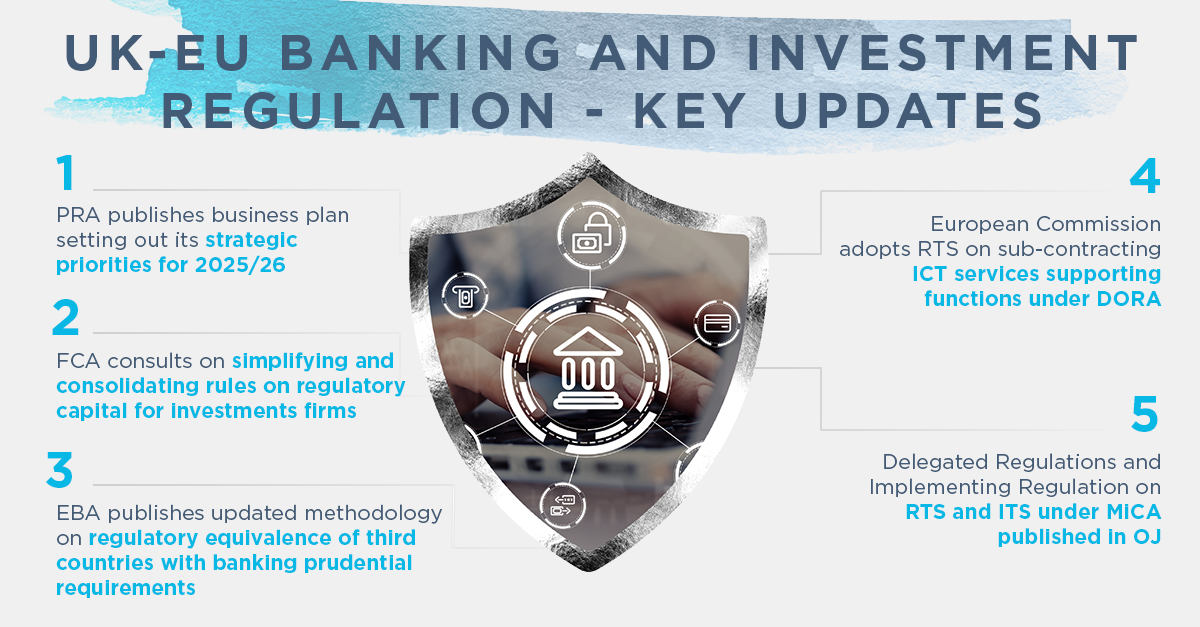

PRA Business Plan for 2025/26

On 10 April 2025, the PRA published its Business Plan for 2025/26. The PRA seeks to be an inclusive, efficient, and responsive regulator, focusing on improving its processes and engagement with stakeholders to facilitate a dynamic regulatory environment. The business plan sets out the PRA's workplan to support delivery of its strategic priorities for the coming year.

Read here to know more on the PRA's workplan and strategic priorities for 2025/26

FCA consults on simplifying and consolidating rules on regulatory capital for investments firms

On 24 April 2025, the FCA published a consultation paper on the definition of capital for investment firms (CP25/10). The FCA's CP25/10 proposes simplifying and consolidating rules on regulatory capital to aid firms in understanding and applying requirements, without altering the levels of capital firms must hold or requiring changes to their capital arrangements.

Click here to read further on what these proposals are

EBA publishes updated methodology on regulatory equivalence of third countries with banking prudential requirements

On 24 March 2025, the EBA published a press release announcing its updated methodology for the assessment of third countries' equivalence with the regulatory and supervisory framework under the EU prudential framework. It has updated the relevant questionnaires for the methodology to reflect the amendments to the revised Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD).

Read more on the updated methodology here

European Commission adopts RTS on sub-contracting ICT services supporting functions under DORA

On 24 March 2025, the European Commission adopted Delegated Regulation supplementing Regulation (EU) 2022/2554 (DORA) with regard to regulatory technical standards specifying the elements that a financial entity has to determine and assess when subcontracting ICT services supporting critical or important functions.

Click here to learn more on these standards

Delegated Regulations and Implementing Regulation on RTS and ITS under MiCA published in OJ

On 31 March 2025, the Official Journal of the European Union (OJEU) published several Regulations containing Regulatory Technical Standards (RTS) and Implementing Technical Standards (ITS) supplementing the Regulation on Markets in Crypto-assets ((EU) 2023/1114) (MiCA).

Click here to see what these technical standards are

Upcoming events

For information on all our upcoming training events including our Regulatory Essentials programme, please visit our Financial Regulation page on our website.