(3 min read)

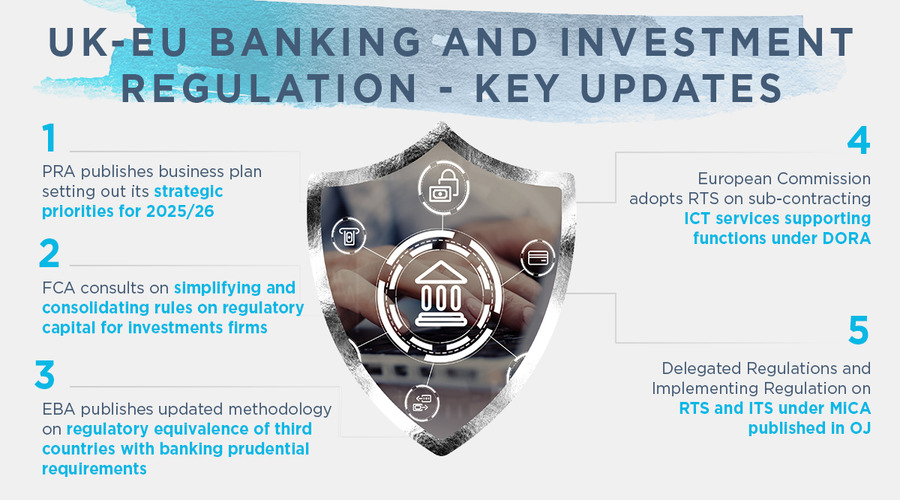

On 24 March 2025, the European Banking Authority's (EBA) published a press release announcing its updated methodology for the assessment of third countries' equivalence with the regulatory and supervisory framework under the EU prudential framework. It has updated the relevant questionnaires for the methodology to reflect the amendments to the revised Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD).

On 24 March 2025, the EBA published a press release announcing its updated methodology for the assessment of third countries' equivalence with the regulatory and supervisory framework under the EU prudential framework. The changes to the methodology reflect the amendments to the revised Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD).

The main goal of equivalence is to manage effectively and facilitate cross-border activity of financial market players in a sound prudential environment, as third countries adhere and adopt the same high standards of prudential rules that are in force within the EU. To this extent, the recognition of equivalence can provide mutual benefits for both the EU and third country financial markets and institutions.

The EBA carries out two types of equivalence assessments: equivalence of the regulatory and supervisory framework, and equivalence of confidentiality and professional secrecy. The equivalence assessment process is a key component for the establishment of cooperation agreements with third countries. Such cooperation agreements cover areas such as the exchange of information with third country authorities relating to equivalence assessment and monitoring, as well as cooperation with EU authorities with regard to supervision, crisis management and resolution matters.

The methodology for the assessment of third countries' equivalence with the regulatory and supervisory framework under the EU prudential framework is based on two questionnaires:

- The 1st step questionnaire consists of a preliminary screening to determine whether the main requirements and principles are in place.

- The 2nd step questionnaire is a more in-depth examination, systematically mapping provisions of the EU framework with that of the non-EU country.

As stated above, the EBA has updated these questionnaires to reflect the amendments to the CRR and CRD. It has also streamlined the 2nd step questionnaire to improve the overall user experience.

The content of the questionnaires has been moved to an online platform, allowing countries to reply directly via a secured digital format. Interested non-EU jurisdictions may get a dedicated access to this platform and are being asked to contact the EBA for further information via Equivalence@eba.europa.eu.