(3 min read)

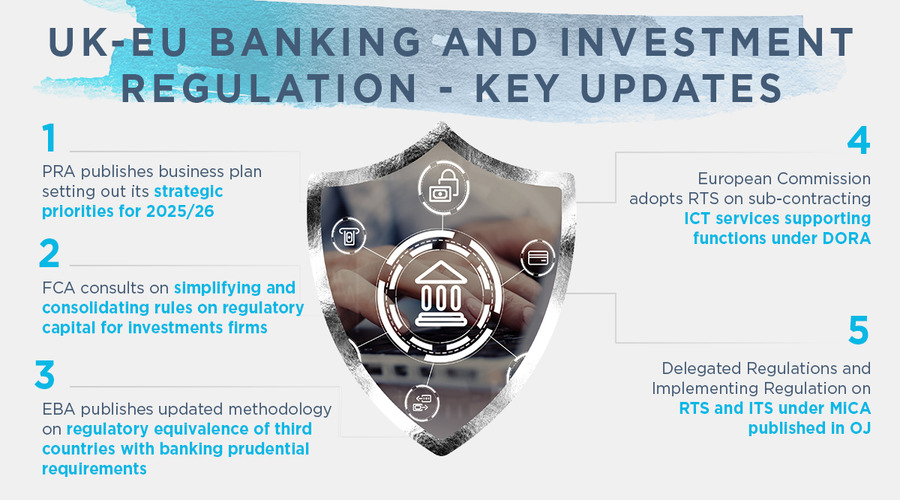

On 10 April 2025, the Prudential Regulation Authority (PRA) published its Business Plan for 2025/26. The PRA seeks to be an inclusive, efficient, and responsive regulator, focusing on improving its processes and engagement with stakeholders to facilitate a dynamic regulatory environment. The business plan sets out the PRA's workplan to support delivery of its strategic priorities for the coming year.

On 10 April 2025, the PRA published its Business Plan for 2025/26, which sets out the workplan to support delivery of its strategic priorities for the coming year and includes an overview of its budget for 2025/26. This year’s business plan particularly reflects the PRA's work to deliver its new secondary objective on competitiveness and growth. The PRA seeks to be an inclusive, efficient, and responsive regulator, focusing on improving its processes and engagement with stakeholders to facilitate a dynamic regulatory environment. This includes maintaining strong performance in handling authorisation applications and continuing efforts to streamline and enhance operational effectiveness. The budget for 2025/26 is set at £343 million, reflecting a commitment to efficiency and the strategic allocation of resources to support the PRA's objectives and initiatives.

The PRA's strategic priorities for 2025/26 are:

- Ensuring the safety and soundness of the banking and insurance sectors, maintaining their resilience.

- Leading in identifying new and emerging risks and developing international policy.

- Supporting competitive, dynamic, and innovative markets, while promoting international competitiveness and growth in the sectors it regulates.

- Operating as an inclusive, efficient, and modern regulator within the Bank of England.

The key regulatory initiatives for the Banking sector for 2025/26 include the following:

- Publishing the Basel 3.1 standards final rules, once Parliament has revoked the relevant parts of the Capital Requirements Regulation (CRR).

- Finalising the simplified capital regime and the additional liquidity simplifications. PRA intends to publish a policy statement on these in Q4 2025, following which it will implement the simplified capital regime.

- Running (with the Bank of England) a Bank Capital Stress Test involving large banks, to inform the setting of capital buffers for both participating banks and at system-wide level.

- Publishing its rules to replace the CRR securitisation capital requirements during 2025 once Parliament has revoked the relevant parts of the CRR.

- Continuing its close supervision of firms’ liquidity and funding risks in light of the lessons learnt from the events of March 2023. In addition, the PRA intends to review the liquidity supervisory framework and consider changes, including regulatory reporting.

- Improving its approach to internal model approvals, and assessing the adequacy of post-model adjustments (PMAs). The PRA will also continue to engage with firms on their implementation of the model risk management principles as set out in SS1/23.

Operational resilience is also a critical theme in its workplan, with the PRA planning stress tests for the banking and life insurance sectors to assess their resilience to financial shocks. The plan also emphasises the importance of cyber resilience, with the PRA undertaking threat-led penetration testing to ensure firms are prepared for cyber threats.

Firms should monitor and engage with the PRA's workplan and priorities. They must be prepared to implement any upcoming regulatory changes, participate in the upcoming stress tests and respond to the regulator's requests for information.