(3 min read)

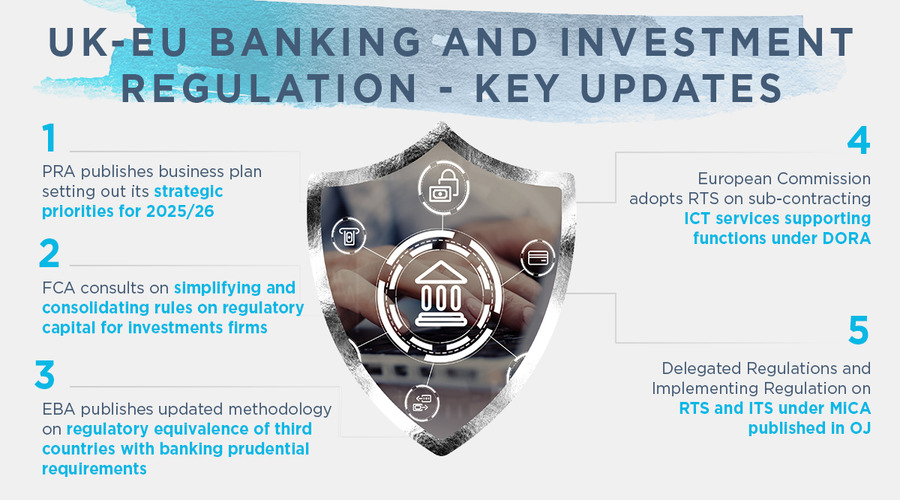

On 24 April 2025, the Financial Conduct Authority (FCA) published a consultation paper on the definition of capital for investment firms (CP25/10). The FCA's CP25/10 proposes simplifying and consolidating rules on regulatory capital to aid firms in understanding and applying requirements, without altering the levels of capital firms must hold or requiring changes to their capital arrangements.

On 24 April 2025, the FCA published a consultation paper on the definition of capital for investment firms (CP25/10).

The FCA's CP25/10 proposes simplifying and consolidating rules on regulatory capital to aid firms in understanding and applying requirements, without altering the levels of capital firms must hold or requiring changes to their capital arrangements.

The FCA intends to remove references to the retained EU law version of the Capital Requirements Regulation (UK CRR) from the definition of regulatory capital for investment firms under MIFIDPRU 3. Many UK CRR rules were designed for banks, making them overly complex and misaligned with investment firms' business models. The proposals aim to simplify the rules, remove irrelevant provisions, and improve clarity, reducing legal text by approximately 70%.

CP25/10 also outlines plans for a more integrated approach to prudential regulation by incorporating simplified own funds rules into the Handbook, laying the groundwork for a consistent framework. This could potentially extend to other sectors in the future, making the proposals relevant to firms subject to other prudential sourcebooks.

A draft of the Definition of Capital for Investment Firms Instrument 2025, which would implement the changes, is included in Appendix 1 of CP25/10.

Comments can be made on the proposals until 12 June 2025. The FCA aims to publish its final rules in a policy statement in H2 2025. Subject to the consultation outcome, it expects the new framework to come into force on 1 January 2026.

The proposed rules will apply to MIFIDPRU investment firms, UK parent entities that are required to comply with MIFIDPRU 3 on the basis of their consolidated situation and parent undertakings subject to the Group Capital Test. They will not apply to banks or other PRA regulated entities. Firms should monitor these proposals and assess any relevant implications arising from the implementation of the new rules once the framework is in place.