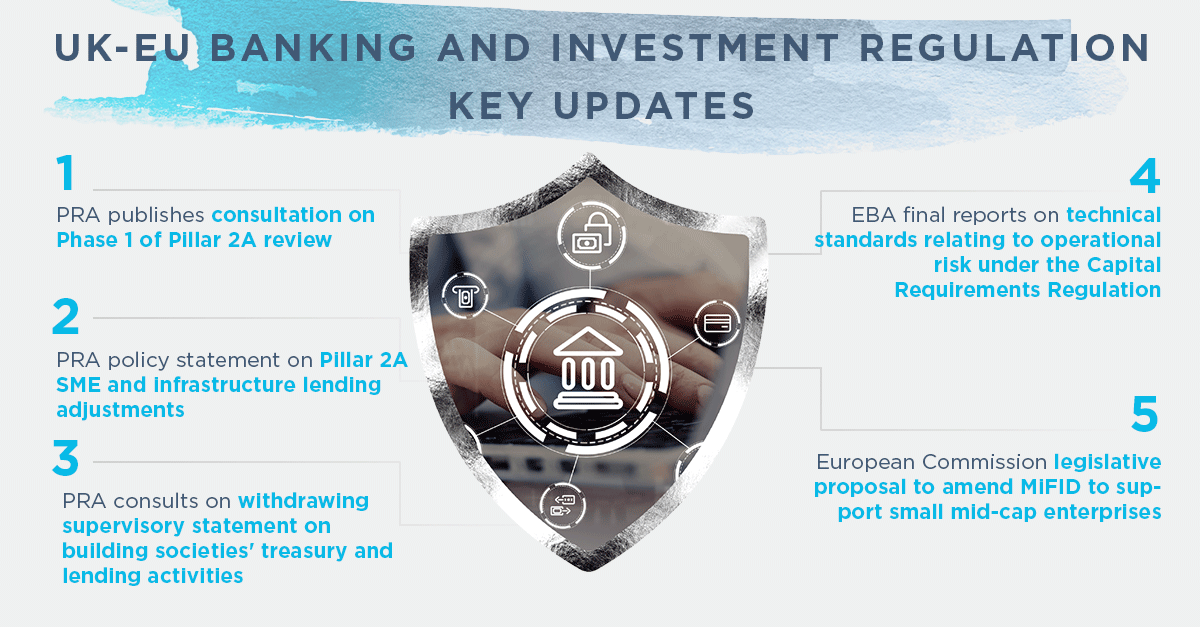

PRA consults on Phase 1 of Pillar 2A review

On 22 May 2025, the Prudential Regulation Authority (PRA) published consultation paper CP12/25, launching the first phase of its review of the Pillar 2A framework to address the impacts of Basel 3.1 standards, enhance transparency, and reduce regulatory burdens. The proposals focus on credit risk, operational risk, pension obligation risk, and market and counterparty credit risk, aiming to improve clarity, proportionality, and consistency

Read here to know more on the PRA's proposals here

PRA policy statement on Pillar 2A SME and infrastructure lending adjustments

On 22 May 2025, the Prudential Regulation Authority (PRA) published a policy statement on Pillar 2A SME and infrastructure lending adjustments. These adjustments aim to mitigate the impact of removing the SME and infrastructure support factors under Pillar 1, as part of the PRA’s implementation of the Basel 3.1 standards. The proposals focus on maintaining the competitiveness of UK firms and minimising disruption to SME and infrastructure lending, while ensuring prudent capital requirements.

Click here to read further on this policy and the PRA’s next steps

PRA consults on withdrawing supervisory statement on building societies' treasury and lending activities

On 8 May 2025, the Prudential Regulation Authority (PRA) published a Consultation Paper (CP11/25) on withdrawing Supervisory Statement (SS) 20/15, which sets expectations for building societies' treasury and lending activities. This is aimed at reducing administrative burdens and provide greater flexibility for societies in managing treasury assets and funding.

Read more on the PRA’s proposals here

EBA final reports on RTS and ITS on operational risk under CRR

On 16 June 2025, the European Banking Authority (EBA) published two final reports on draft technical standards relating to operational risk under the Capital Requirements Regulation (575/2013) (CRR). They set out the standards specifying the components of the operational risk business indicator and the use of those components, and on supervisory reporting requirements related to operational risk under Article 430(7) of CRR.

Click here to learn more on these standards

European Commission legislative proposal to amend MiFID to support small mid-cap enterprises

On 21 May 2025, the European Commission published a legislative proposal to amend Directives 2014/65/EU (MiFID II) and (EU) 2022/2557 to extend certain mitigating measures currently available to small and medium-sized enterprises (SMEs) to small mid-cap enterprises (SMCs). The amendments are designed to extend to SMCs the support currently available to SMEs to access SME growth markets.

Click here to read more on the Commission’s proposals here

Upcoming events

For information on all our upcoming training events including our Regulatory Essentials programme, please visit our Financial Regulation page on our website.