This article reports on the first of the Office of Rail and Road's PR18 Working Papers.

Initial consultation on PR18

We reported in June on the Office of Rail and Road (ORR)'s initial consultation on PR18 – see 2018 Periodic Review of Network Rail, which closed on 10 August. In conjunction with, and to supplement, this the ORR have also been publishing five Working Papers and over the next few weeks, we will be summarising each of these in more detail.

Implementing route-level regulation

The first working paper, Implementing route-level regulation, was published on 7 June.

Network Rail are increasingly devolving responsibilities to a route level, as recommended by the Shaw Report. This has the benefit of enabling Network Rail to work closely with the train and freight operating companies.

However, it has major implications for how the ORR conducts the 2018 periodic review (PR18) and how the ORR will monitor its delivery in Control Period 6 (CP6: covering 2019-2024). There needs to be clarity about the relationship between the routes and Network Rail centre and how each interacts with the ORR, governments, train operators and other stakeholders.

The ORR states that route level regulation will need to reflect:

- That Network Rail is a single legal entity and the Board is ultimately responsible. Network Rail needs to consider how its corporate centre relates to its routes as this will be a key factor in the degree of ownership that the routes feel and correspondingly how effective a route-level regulatory approach will be;

- The benefits to customers of a single, national network. This will be delivered through the "virtual route" for national passenger and freight operators (as recommended by Shaw) and also Network Rail's national system operator function, which we will cover in future briefings;

- Customer-focused plans, as the routes will need to engage more closely with customers in setting their outputs; and

- The statutory requirements on the relationships with Government in terms of setting the High Level Output Specification (HLOS) and Statement of Funds Available (SoFA), as this may constrain the routes' ability to prepare independent plans.

Potential framework for PR18 determination

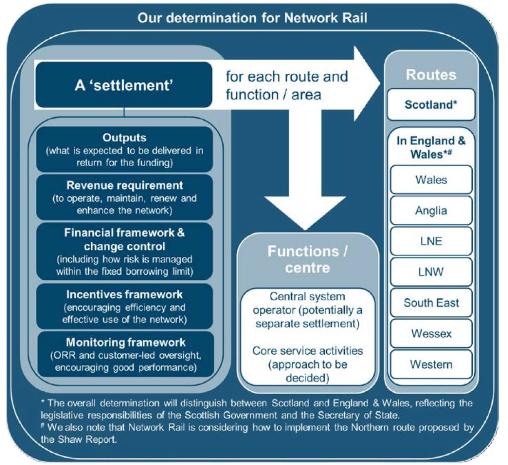

As set out in the Initial PR18 Consultation, the ORR is proposing a single determination for Network Rail as a whole, but made up of separate settlements – one for each route plus possibly one for its system operator functions, as set out in this diagram:

Taking each element of the route-level settlement in turn:

- Outputs: Some outputs will be determined at route level, potentially building on the progress Network Rail has already made with route scorecards. There will need to be a degree of consistency across route-level outputs, to ensure routes can be compared and benchmarked.

- Revenue requirement: Each route will have its own funding settlement, with funding determined at route level. This will provide a baseline against which to measure financial performance. The ORR would apportion Network Rail's total England & Wales debt and RAB to each route and they will consult on the allocation methodology for CP6 in a December 2016 financial issues paper (see timetable).

- Financial framework: The ORR need to decide how routes will deal with financial risk given that Network Rail, as a single company, can move funds from one route to another. The ORR will consult in late 2016 on this in their financial framework consultation.

- Incentives: A key issue in PR18 is how the regulatory regime can provide the right incentives for Network Rail to accommodate traffic growth. The ORR will need to consider how much route-level regulation will have implications for the structure of charges. For example, to incentivise route teams to collaborate with customers to reduce costs and/or identify opportunities for new services, the ORR may have to ensure a sufficiently strong link between costs within a route and the resulting income from charges at that route level.

- The ORR will review the existing incentive regimes to ensure they work effectively for route-level devolution including REBS, the volume incentive and Schedules 4 and 8. They will consult in December 2016 on charges and contractual incentives (i.e. Schedules 4, 7 and 8 of the track access contracts).

- Monitoring: The ORR anticipates monitoring a wide range of outputs at route level including asset management, performance, network availability, and any measures that reflect system operation at route level (such as signalling). There should also be a framework for monitoring the effectiveness of routes' engagement with their customers and stakeholders.

Periodic review process and interfaces

The Working Paper sets out a "strawman" proposal on how the interfaces between different stakeholders during the periodic review process might work to maximise the benefits of route-level regulation. This is to support discussion and further policy development; it is by no means set in stone yet.

The ORR will prepare guidance for Network Rail, informed by the IIA (initial industry advice) that the Rail Delivery Group submits to the UK Governments in Autumn 2016. The ORR Guidance, to be published in February 2017, would set out what the ORR require from routes and the ORR's expectations regarding the role of Network Rail centre. As far as practicable, it would be based on Network Rail's own processes and guidance to its routes.

Network Rail centre will then translate the ORR's requirements into guidance for the individual routes.

The ORR will help the governments frame their HLOS in a way that can best support route-level regulation, e.g. setting objectives for what the Secretary of State wants delivered, rather than specific outputs like national performance targets, to allow Network Rail more flexibility. The DfT agrees with this approach. In their Response to the PR18 Initial Consultation Document, the DfT says that PR18 is likely to see a much higher-level HLOS and accompanying SoFA, which will enable greater flexibility to take forward and fund additional new enhancements on a rolling basis, enable better alignment with franchising and facilitate a broader range of funding models.

The ORR envisages that each route will produce their own RSBP (route strategic business plan) which will include subsidiary "strategic route asset plans" for each relevant asset area, system operation activities that take place at a route level, and plans for delivering outputs, as well as evidence of customer engagement. The RSBPs will be a key part of the evidence base for the ORR's determination.

There is a tension between routes having full accountability and ownership of their plans and the ultimate corporate accountability of Network Rail centre, given that Network Rail remains a single company. Too much oversight by the centre would inhibit the benefits of devolution and comparative competition, but too little risks an incoherent and unaffordable set of plans. So, although each route produces its own RSBP, Network Rail centre will need to be involved.

The working paper discusses how to manage what happens if one route disagrees with the final settlement decision and how Network Rail could handle that.

Comment

The Working Paper envisages the ORR working closely with Network Rail to come up with a system of regulation at route level that builds on the work Network Rail is already doing to devolve responsibility to route level. This needs to be complemented and overseen by a central "system operator" function within Network Rail and we will report on this in a future briefing.

This could be a ground breaking development with far reaching consequences particularly for Transport for the North and future devolved transport bodies as it potentially paves the way for a greater degree of influence at local level and highlights in particular the potential value of the implementation of the Northern route as recommended by Shaw just as Transport for the North is expected to become the first sub-national transport body under the Cities and Local Government Devolution Act.

Michael O'Connor

Partner, Chair of Government Contracting Group, Co-head of Healthcare Sector

United Kingdom