Every three years, as a condition of State aid approval, the Department of Energy and Climate Change (DECC) has to review the feed-in tariff (FIT) scheme. This is handy timing for DECC, which is currently looking at ways of controlling spending on renewable energy.

See our previous briefing, Taking Control of the Levy Control Framework for more background. DECC has now issued a consultation on a review of the FIT scheme which proposes a number of crushing measures to FiTs.

Rationale

Despite opening with the sentence "Government is committed to moving to a low-carbon economy and meeting its carbon reduction and renewable energy targets", it is clear that the main motivation for the FIT review is cost. The Impact Assessment accompanying the consultation admits that "the primary policy objective is to control spending under the FITs scheme, with the intention being that a maximum of £100m is spent on new-build deployment over this FITs review period." According to evidence published alongside the consultation, deployment of wind, anaerobic digestion (AD) and hydropower have exceeded DECC's 2012 projections, and solar PV is expected to be within DECC's projected deployment ranges by the end of 2015/16. DECC are therefore seeking to rein in the spending on the scheme and so the consultation proposes a number of measures, likely to take effect from around January 2016, which will reduce (and potentially even remove) the amount of subsidy available under the FIT scheme.

Changes to generation tariffs and banding

The FIT subsidy consists of a generation tariff for electricity generated on-site and an export tariff (currently 4.85p/kWh) for unused electricity that is exported to the grid. At present, most renewable generation sites claiming FITs cannot record how much electricity they are exporting, so there is a deemed export percentage of 50% for wind, AD, CHP and solar PV installations under 30kW; and 75% for hydro. The consultation does not propose changing the export tariff (for now), but it does propose changes to the generation tariff.

Simplifying tariff bands

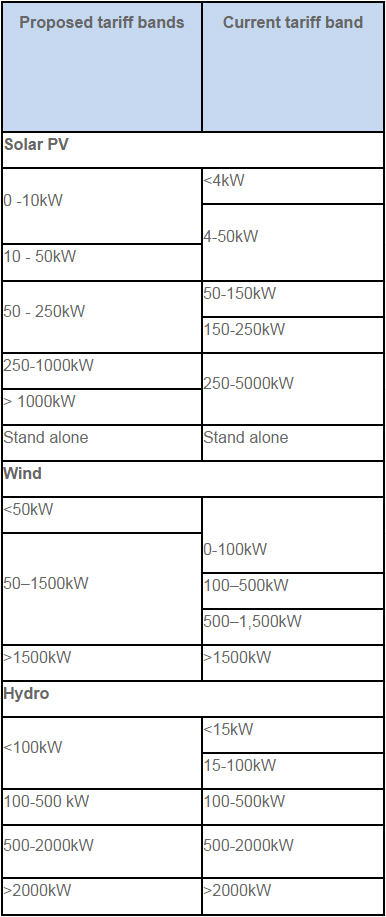

The consultation proposes to merge some tariff bands to simplify the scheme and to minimise the opportunity for "gaming" tariffs such as de-rating wind turbines so that they can claim a higher tariff for a lower output. The changes only affect solar PV, wind and hydro. There are no changes to the bands for AD or micro-CHP. You can see from the table below that the minimum solar PV tariff band will increase from 4kW to 10kW and then the 50-150kW and 150-250kW bands will be combined into one. The 250kW to 5MW band will be split into two at 1MW.

With wind power, the lowest tariff band will be lowered to below 50kW, then there will be a single tariff for 50kW to 1.5MW, abolishing the 500kW banding that has allegedly led to de-rating turbines.

The only change for hydro is to raise the threshold for the first tariff band to 100kW, i.e. remove the under 15kW tariff band.

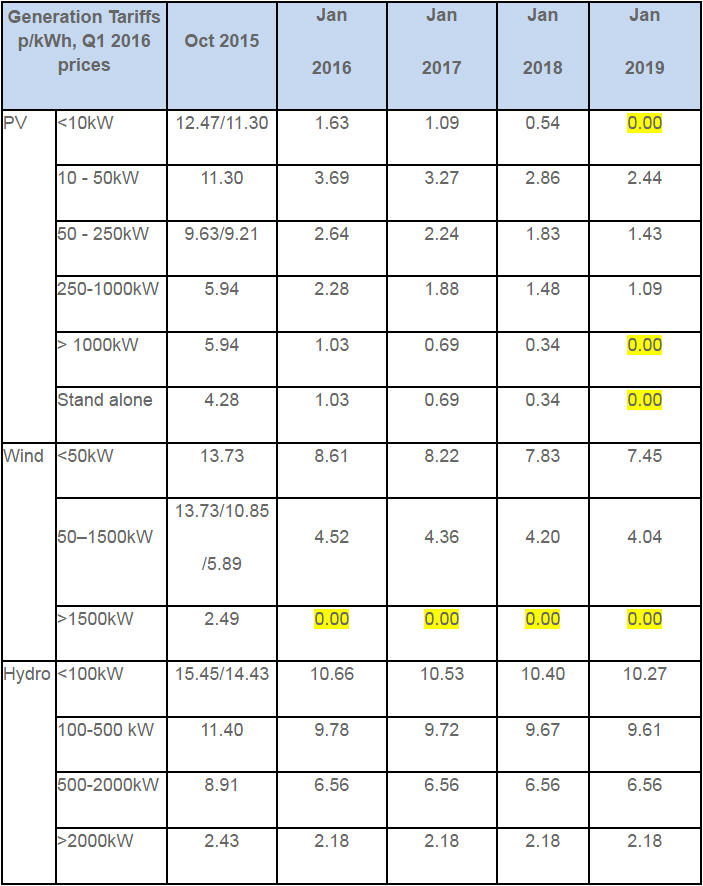

Degression and deployment caps

The consultation proposes that tariffs will automatically degress every three months for all technologies. At the moment, only solar PV tariffs degress quarterly, the others degress every six months. So this means that AD, hydro and wind power tariffs will degress twice as frequently in future. Below are the the proposed tariff levels and their default degression across all technologies to 2019 (excluding April, July and October for simplicity), and for comparison purposes we have included the October 2015 tariffs (but note that the bandings do not match exactly):

We have added highlighting to show that solar PV below 10kW and above 1MW, and all stand alone solar PV, is expected to be generation tariff subsidy-free by 2019. Wind power above 1.5MW will no longer receive any FIT generation tariff from January 2016.

The new (in most cases much lower) tariffs have been calculated according to the latest cost evidence, of which there is more detail in the documents accompanying the consultation, and to give a target rate of return of 4% for solar PV, 5% for wind and 9% for hydro. Note that the tariffs have been calculated on the basis that the right to pre-accredit (and "lock in" a tariff) is removed, even though the consultation on this has only just closed.

In addition to this automatic quarterly degression, there will also be contingent (deployment-based) degression of 5% where deployment exceeds projections and 10% when a deployment cap is reached. Like the default degression, contingent degression will take place on a quarterly basis for all technologies.

Deployment caps

As mentioned above, the primary purpose of the consultation is to get the FIT scheme limited to a maximum overall budget of £75 - £100 million. This will be enforced via deployment caps for individual technologies and degression bands. These caps will work independently of one another so a cap could be hit for one degression band without affecting other technologies or different tariff bands of the same technology. Once a cap is reached, no further installations will be eligible for the generation tariff in that quarter. The proposed caps also apply to AD projects (unlike the revised generation tariffs and degression) and the caps are not generous: around 2.7MW a quarter for AD projects up to 500kW (equating to only 3 installations) and 4.4MW reducing to 2MW a quarter for larger AD projects (around one a quarter). Stand alone solar is capped at 5MW a quarter.

The real problem will be how to determine when the cap is reached. DECC propose to use data from the MCS database (for sub-50kW solar PV and wind) and Ofgem's records of applications received for full accreditation under the ROO-FITs accreditation process (for above 50kW solar PV and wind, and all AD and hydro projects). The timing (to the second) of the issue of an MCS certification or the receipt of a ROO-FIT application will be critical.

Installations that miss out on a cap could either be rejected and required to re-submit at the start of the next cap period; or continue to be processed and receive the tariff of the cap they qualify under. DECC are asking for views on which option is more suitable.

Indexation

A minor (and not unexpected) change, but one that will serve to reduce tariffs even further, is that tariffs will be aligned to the CPI rather than the RPI inflation index. The CPI is around 1% lower than RPI, which means tariffs will not increase by inflation as much as they have done.

The real impact of the cap

Despite all the above, there is a risk that the entire FIT scheme might be scrapped as early as January 2016 if DECC think that all these measures will not be enough to keep spending under the £100 million budget. The consultation warns that "the future and size of the scheme will be determined by affordability criteria" and this will be determined by factors including (but not limited to):

- Applications under the scheme before full implementation of the outcomes of this review

- Government's confidence in the implementation of an expenditure cap

- Future generation tariffs settled through this consultation

- Deployment in other areas of the Levy Control Framework

- Government's decisions surrounding other renewables priorities.

This clearly leaves DECC with a lot of wriggle room if they can't get the FIT to fit within the budget – and places a strong incentive on industry to agree to the lowest possible level of tariff as that is better than no tariff at all.

Limits on scheme

DECC also propose (not surprisingly) that new technologies should not be added to the FIT scheme and nor should it be extended to Northern Ireland. Also, any extensions to already-accredited installations will not be able to claim FITs: this is to avoid developers building out a project in stages, to receive a higher tariff for a smaller installation at each stage, rather than all at once.

Energy efficiency

At the moment, buildings with a solar PV installation have to provide an Energy Performance Certificate (EPC) showing that the building is rated D or higher, by the eligibility date in order to receive the FIT. The consultation proposes requiring the EPC certificate to be obtained before the solar PV installation is commissioned, which is much earlier than the eligibility date. In the future - there will be a further consultation - DECC are thinking about making it a requirement to have an EPC band C certificate in order to receive the FIT, so that buildings that can't meet that efficiency standard will get no subsidy at all – with the exception of schools, community energy projects and fuel poor households.

DECC may also extend the EPC requirement to other forms of renewable energy, not just solar PV, and raise the installation size limit to above 250kW.

Export tariffs and smart meters

DECC are not proposing any change to the export tariff at the moment, but they are consulting on options to ensure its long-term sustainability. This is because, with the fall of wholesale prices recently, the export tariff is higher than the wholesale electricity price so generators are being over-compensated. DECC are asking for views on: withdrawing the right for >50kW installations to opt for the export tariff as they can sign a PPA with their FITs licensee instead; re-basing the export tariff to a lower level; and an annual re-set of the export tariff to a wholesale power price index.

In the future, DECC will be looking at measures to align the FIT scheme with the roll-out of smart meters, which is likely to mean an end to deemed export percentages and instead measuring the actual amount of electricity exported via a smart meter – which could mean new entrants being required to have a smart meter installed before claiming FITs.

Requirement to notify DNO

Given the impact of distributed generation on the electricity network, it is no surprise (other than that it has taken this long) that DECC are proposing to introduce a requirement that DNOs are notified of all new generation installations.

Impact on AD plants

The news for AD is mixed. The revised lower generation tariffs and default degression will not apply to AD plants, but the contingent quarterly degression of 5% and 10% based on deployment will, as will the overall cap on deployment in any quarter which is around 2.7MW for AD projects up to 500kW (equating to only 3 installations) and 4.4MW reducing to 2MW for larger AD projects (around one a quarter).

DECC are also considering introducing a sustainability requirement on AD plants that seek to claim FITs. This will be aligned with the sustainability criteria under the Renewable Obligation (RO) and Renewable Heat Incentive (RHI) so that installations that can't meet the RO and RHI criteria do not all gravitate to the FIT instead.

Existing FIT installations

At least there's some good news (or more appropriately, no bad news) for installations that are already claiming the FIT, which is that DECC have reaffirmed their commitment to the principle of grandfathering generation tariffs so those existing installations will continue to receive the same level of FIT.

Comment

Whilst the consultation is not unexpected, we have now seen a number of damaging measures to the renewables industry, after what is the third severe policy announcement in recent months. The government argues that solar and onshore wind should be able to largely support themselves yet there is now a heightened risk that the latest cuts will kill off a promising industry before it is able to generate subsidy free. The next 12 months will be critical times while the industry seeks to adapt to its new environment (which unfortunately is unlikely to be as green as before).