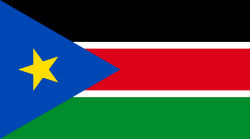

Country overview

Population

12.2m

President

Salva Kiir Mayardit (since 9 July 2011)

Capital city

Juba

Major industries

Agriculture, petroleum products

Currency

South Sudanese pound

Languages

English (official), Arabic (includes Juba and Sudanese variants), regional languages include Dinka, Nuer, Bari, Zande, Shilluk

Major religions

Animist, Christian

Legal information:

- Capital markets

Exchange

There is no capital markets exchange in South Sudan.

- Corruption / transparency

UNAC ratified?

No

Ratified?

No

Signatories to United Nations Convention Against Corruption (UNAC)?

No

Corruption Perception Index rank worldwide for 2017

179

Signatories to the African Union Convention on Preventing and Combating Corruption?

No

Corruption Perception Index score for 2017

12

Signatories to the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions?

No

- Disputes

Judiciary

The Judiciary of is the constitutionally mandated government branch that oversees the court systems of South Sudan.

The Chief Justice of the Supreme Court of South Sudan is the head of the judiciary, and is held accountable by the President. The current Chief Justice is Justice Chan Reec Madut.

The institution was created after the Comprehensive Peace Agreement took effect in 2005.

Structure of the court system

- Supreme Court

- Court of Appeal

- High Court (highest at state level)

- County Courts (1st and 2nd Grades)

- Town and Rural Courts

- Foreign investments

Foreign investment rules

If there is anecdotal evidence that a company in Southern Sudan has at least 10% Sudanese interest, then there are no restrictions on:

- foreign investments;

- land ownership for business purposes; or

- the need for local participation in establishing a foreign investment.

- Taxation

Capital Gains Tax

Included in taxable income and subject to corporate tax.

The rates are as follows:

- 10% on small businesses

- 15% on medium-sized businesses

Corporation tax

A resident company will pay tax on worldwide income - a non-resident company only pays tax on South Sudanese source profits.

The rates of taxation are as follows:

- 10% on small businesses

- 15% on medium-sized businesses

Exchange control

There are no exchange controls, but significant foreign exchange transactions must be reported to the central bank.

Interest

A final withholding tax of 10% on the gross payment is imposed, regardless of whether the recipient is a resident.

Export Processing Zone

N/A

Dividends

A final withholding tax of 10% on the gross payment is imposed, regardless of whether the recipient is a resident.

Losses

Losses can be carried forward for up to 5 years but cannot be carried back.

Payroll tax and social security

Must withhold payroll tax based on a monthly average:

Income in SSP - Rate

- Up to SSP 300 - 0%

- SSP 301-5,000 - 10%

- 5,001 and above - 15%

There is no legislation on social security, but in practice 17% must be contributed.

Personal income tax

Paid by those domiciled in South Sudan, or those physically present for 183 days or more in any tax period, in the following proportions:

Income in SSP - Rate

- Up to SSP 300 - 0%

- SSP 301-5,000 - 10%

- 5,001 and above - 15%

Real property tax

There is no specific legislation, but rates vary by locality.

Royalties

A final withholding tax of 10% on the gross payment is imposed, regardless of whether the recipient is a resident.

Stamp duty

There is no legislation related to Stamp Duty, but it is widely applied. The rates depend on the type of instrument.

Technical service fees

N/A

Thin Cap regulations

N/A

Transfer pricing

N/A

Value Added Tax

There is no legislation related to VAT, but 10% is charged.

- Competition regulation

Legislation

There is no merger control regime in South Sudan but it is a member of the Common Market for Eastern and Southern Africa (COMESA).